If you’re thinking about joining a startup accelerator program, it’s essential to consider the advantages and disadvantages before signing up. Accelerators are high-risk programs that offer little collateral in return for investment, so it’s necessary to understand what you’re getting into.

Accelerators are designed to provide mentorship and seed funding for entrepreneurs with high potential ideas. But is it worth it?

One key to determining what type of program is the best for your startup is to determine what you are trying to accomplish.

For example, if you might be looking for investments, it would be safer to go with a more experienced accelerator with access to investors than one without access.

If you want feedback and connections in the same industry, then an industry-specific accelerator may work better for you than another general lifecycle or vertical-specific accelerator.

Ultimately, your goal will dictate which type (style) of accelerated startup program is right for you.

A startup accelerator is a program for venture-backed startups when they need the experience to help them grow their companies and guidance and support to make it through the current ecosystem of challenges.

Often, startups do not know how or where to find funding opportunities, distribution channels, and other essential aspects that can help them succeed because they are new on the scene at both idea and execution levels.

These are all out of necessity, though, providing legitimacy with industry professionals and exposure that’s needed for that next step towards sustained success among more competitive ventures.

Startup accelerators are a great way to get the resources you need and make connections with potential customers. They can also be an excellent way to test out your idea, build credibility in your industry, or raise money.

If you’re considering applying for one of these programs, take some time before making that decision, so you know what they offer and how it relates to your business goals!

Do Accelerators Cost Money?

The first question many people have when they hear of startup accelerators is whether or not they cost money. The answer to that is yes, but there are a couple of ways for people to get around the cost and still take advantage of what an accelerator has to offer.

The good news is that a large number of accelerators are entirely free. On the other hand, some startup accelerators charge enormous fees upfront, from 1 to 2 million dollars or more.

Not only that, but these types of programs often require equity in your company in exchange for attendance at the program, and they may also ask for subsequent additional investments from founders belonging to their alumni networks.

Startup accelerators are expensive, and they are also very selective, and you may have a difficult time finding one for free.

Some accelerators are only for nascent startups with no revenue lined up, whereas others will take companies already generating revenues but could be poised for growth.

To put it into perspective, we’ll assume the company you’re looking at is an average startup with a few years under its belt but little to show in terms of revenues or partnerships. It would usually cost to start such a venture from scratch averages around $120,000 – $150,000.

For a $120,000 upfront investment, they’ll usually provide you with workspaces and mentorship from experts for two to three months.

For all but the most established startups, startup accelerators will be a good choice financially because of one fundamental principle: high risk + low margin = high reward.

Even if your company doesn’t work out (in fact, especially if it doesn’t work out), you’re still guaranteed to make more money than if it never existed in the first place.

Startup accelerators are programs that provide startups with mentorship, training, and seed funding in exchange for equity.

Generally speaking, the cost of a startup accelerator is $120k – $150k to participate over four months. It’s an expensive but worthwhile investment if you can get accepted because it will give you access to mentors who have already made successful companies as well as network connections from investors.

If your company doesn’t meet their criteria or there aren’t any open seats available, they could be out of luck for this round; however, some incubators offer more scholarships than others, so start researching now!

Are Accelerators Profitable?

To better understand the profitability of Accelerators, we need to look at how they are set up in a typical model.

The most common type is an equity accelerator, where founders give away ownership in their company or intellectual property for capital and other benefits.

When startups graduate from these programs, they can be worth significantly more than when they entered them. This means that accelerators may very well be profitable – if you have enough success stories.

The most successful accelerators provide a valuable service in the form of their companies, and they do this by raising money from individual and institutional investors.

These types of programs aim to attract return-seeking investors who want to receive enormous returns on equity or debt investments.

Accelerator models that support low-cost hosting facilities, thus far, haven’t been successful because they don’t serve the needs of angel or venture capital investors well enough.

Accelerators are a common practice in the tech industry. However, accelerators can be profitable for some companies and not others.

To understand why this is so, it’s essential to look at what an accelerator does and how they work with startups.

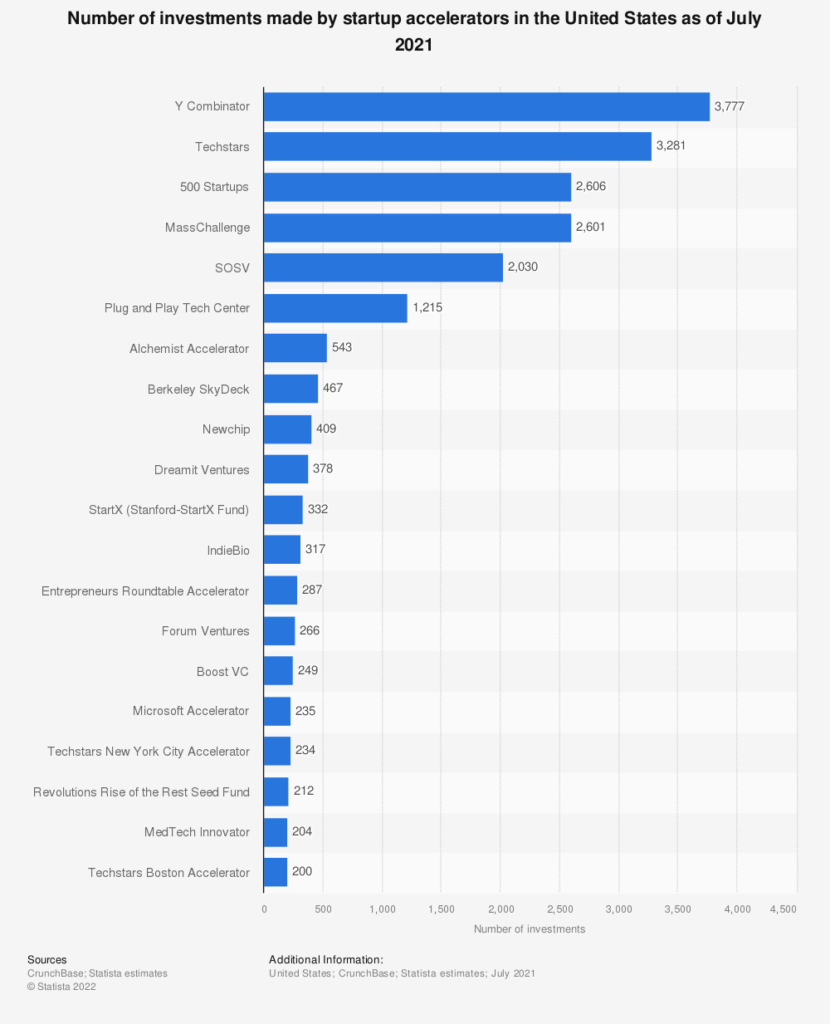

For example, Y Combinator uses strategy sessions that focus on business models and weekly dinners with prominent speakers from both within their network of entrepreneurs and outside of them who share expertise, such as venture capital partners or startup CEOs.

This approach encourages founders to think about the future needs of consumers while also keeping tabs on trends happening right now across industries that will impact their own company down the line.

Accelerators have led to some great success stories, but many have failed. As the industry matures and accelerators continue to pop up worldwide, it will be interesting to see how these programs evolve.

Advantages And Disadvantages Of Accelerators

Accelerators are a popular way for startups to get funding, grow their business, and gain experience. This can be an excellent opportunity, but there are also some disadvantages.

The apparent advantage to accelerators is that you’re getting access to mentors who will help guide your startup through its infancy stage.

You’ll be able to work with experts in many different industries, so your idea will likely fit one of those niches well enough for you to succeed in it.

However, there is still plenty of work left to you often; the accelerator provides only the basic necessities like office space or administrative support. At the same time, you’re expected to do all other tasks.

The advantages of accelerators:

1) Allows for more efficient use of the company’s capital as it does not have to commit large sums before being convinced of success in the project.

2) It provides intellectual property protection for startups which is essential with the rise of patent trolls.

3) Accelerators guide how to develop prototypes, strategic plans, and lead meetings. This guidance often leads to long-term mentorship or feedback from those working at successful companies in the field they are entering into.

4) A program can offer space either at their office location or through virtual space where startups work without incurring expenses that may be hard if a startup has just raised funding and would like a more intense experience than that offered by co-working.

The disadvantages of accelerators:

1) Accelerators are incredibly time-consuming. The time required for startups to devote full-time to incubation/acceleration exceeds 50 hours per week. This means you don’t have enough time to build your network by yourself outside of acceleration and grow your company before they kick you out.

2) They inhibit creativity through the need to have a specific answer every week for a set number of weeks.

3) Lack of access to mentors, guides, and resources from successful entrepreneurs and company founders to others who are still in the beginning stages of business development.

4) Usually an all-or-nothing situation: either you get in and graduate, or you go back to square one with your idea (sometimes called “crowdfunding”), not knowing any more than you did when you started on that idea road map.

Accelerators can be a great way to get your startup off the ground, but there are some disadvantages that you should consider before jumping in. The key is to weigh all of these factors and determine if an accelerator program is right for you or not based on what will work best with the goals and needs of your business.

How Much Equity Do Accelerators Take?

The equity taken by an accelerator varies depending on the program, and the typical range is between 7-10%.

Some accelerators have a higher threshold for investment, such as Y Combinator, which requires a $150k minimum and takes 20% of all company equity.

Many accelerators offer some level of discounted or free services in exchange for taking more equity from startups.

For example, Techstars offers up to $20k worth of services with no equity taken but does take 6% if they can invest in the company at the end.

Founders must understand what type of deal each accelerator offers before applying because no standard agreement applies across programs.

Theoretically, the more money an investor gives to a startup, the more they expect to receive back on their investment.

Similarly, accelerator programs often claim an equity stake of 10%. But in reality, this dominant investing culture deprives startups of much-needed capital (by soliciting funds upfront) and forces them into a rushed timeline (to satisfy board members’ expectations).

Thus some postulate that accelerators’ policies prohibit technology development – as opposed to enabling it.

What Is A Startup Cohort?

A startup cohort is an organization that helps entrepreneurs develop their startups. They provide a shared working environment or office space, events to attend, and access to other resources and mentorships necessary for startup growth.

There are many benefits to joining a startup cohort.

- You will be surrounded by like-minded people who have similar goals as you do in life.

- Experience working closely with an experienced mentor.

- Networking and connections from the cohort members and cohorts themselves.

- access to up and coming organizations in new industries, fields, or technologies.

- Salary at market rate starting out, opportunities for good advances in pay as you gain experience (something that is not always possible through standard work).

- Challenge yourself with assignments that might be outside your current skill set but which might inspire you to learn something new.

Conclusion

Accelerators provide an invaluable opportunity to learn from others and build connections, but they’re not for everyone.

They typically require a significant upfront investment of time and money, as well as a large amount of equity that you may not have the ability or desire to give away.

It is essential to weigh all your options before choosing whether or not this type of mentorship will be worth it in your situation.

If you decide on becoming part of an accelerator program – make sure you know what types are out there so that you can choose one with the best fit for you!

Glossary

A startup incubator is a physical or virtual space, typically in an academia or business establishment such as a research institute or science park, designed to catalyze innovation and entrepreneurship by providing support services for entrepreneurial ventures and the startup founder.

A business accelerator is a “support system” where small businesses are given the resources they need to grow, such as connections with other companies or experts, advice in planning and financing, counsel on marketing and design.

A startup ecosystem is a close-knit network of entrepreneurs, venture capitalists, angel investors, and mentors collaborating in an area to make it easier for an entrepreneur and startups to thrive.

Accelerator graduates are entrepreneurs who received seed funding from a tech incubator or venture capital fund.

A founders factory is a company that helps startups get started and provides the necessary support to help them grow.

A startup studio is a company or organization that customizes its consulting services to meet the needs of each client.

A business incubator is a company with funding or investment capital to help startup businesses. Unlike conventionally financed companies, these don’t get paid back until later on once the company is stable and generating profit.

An angel investor invests time and capital in startups, typically outside the circles of family, friends, or passive investors.

Early stage institutions are organizations that provide an education in entrepreneurship. They all vary in scope and focus, but typically, they are geared towards giving students the training to identify a business idea and develop a plan for their early-stage company. Some early-stage institutions also help with funding for after graduation endeavors as well.

A seed accelerator is an early-stage startup accelerator that focuses on providing potential investors, mentorship, and resources to seed-stage portfolio companies to create a successful entrepreneur. These participating startups are generally in the product concept or prototype stages.

An accelerator experience is an opportunity to meet mentors, investors, and active startup founders from the region. Many people join an accelerator because they want to have that access.

A pitch deck is a presentation created to persuade someone to invest in your business. A well-made pitch deck by the founding team should contain all the information about your product/service that investors might want to know: Market opportunity, competitive landscape, strategy, team experience, corporate partners, and fellow entrepreneurs.

An accelerator program is a selective seed-stage investment program providing mentorship, coaching, networking opportunities with other accelerator participants and the startup community in return for equity.

500 Startups is a venture capitalist that focuses on creating high-visibility, accelerated, and profitable businesses.

Silicon Valley is the birthplace of America’s tech industry. It began with Fairchild Semiconductor, founded in 1957, and the company kicked off the trend for high-tech chip design that led to modern smartphones, computers, and other devices.