The first question we often hear about startups is how they spend their funding. Whether you’ve just started your business or are looking to invest in a new one, having this information can be very valuable as it can predict the future of that company and help show its potential for success.

Startups spend their funding on growth, marketing, and R&D. These three areas are critical to the success of any startup.

If a startup is going to use savings or personal funds, then the best way to spend their funding would be on a couple of things. The first thing they might invest in is tangible assets that will generate the most value over time. If money permits, the second thing startups should invest in is hiring services such as marketing and public relations agencies.

Here are ten considerations for startups’ expenditures:

- Build brand awareness – Advertising, promotions and market research. They can offer loss leaders to draw people’s attention into the store. They can provide educational services that include seminars, workshops, special events or programs that increase customer retention rates or promote cross-selling of products and services.

- Leveraging your customers – Startups should identify their repeat customers, find out what they want or need, and offer them new services or products. This demonstrates that the company is listening to customer feedback and using it to improve. It also encourages more customers to become repeat buyers in the future.

- Investing in employees’ skillset – The most important investments for most startups are in finding people for their core positions who are top of their game. After identifying these individuals, companies can then invest heavily in training them both on-the-job and outside of work by providing courses on topics like research, industry skill sets, language learning programs, etc.

- Utilize interns to do the grunt work – Bill Gates started his company with two options, take a summer programming course or intern at Honeywell. He chose the latter one because it gave him experience by doing real programming, not just theory.

- Lower costs of goods sold via lower prices or higher volume – Price aggressively for high volume products with low margins (e.g., commoditized). Lower cost if possible via outsourcing production or other work that can be done remotely but still produces value for the company at a lower cost than you currently incur locally.

- Join forces with other companies in your industry to collaborate and share work together with outsourced operations – Which has many benefits including diversity of ideas, expertise, efficiency of time, etcetera.

- purchase machines to do the work – AI that doesn’t need human intervention or judgement for accuracy sake. The cost may be expensive but it is a long-term investment as you will not have to hire anyone as those positions can be automated.

- Find new funding – By seeking new investors you could assume some level of risk behind their capital which would help grow your company into something bigger than he envisaged it would originally be, assuming the new investors are using funds from personal wealth rather than borrowed money.

- Bounce off of complementary businesses – A complementary business is one that suits your original product by providing an additional service or extending its coverage into different market segments.

- Take risks – Learn from the risks taken and grow strong together with staff. Invest for growth gradually enough that it is sustainable and measurable, sow good seeds daily then reap sustainable success over time without too much pressure.

The good news is that it’s possible to start a company with very little funding, and you need the right tools and knowledge of what you should be doing on any given day, week, or month to get your startup off the ground.

If you’re in the process of starting a startup or are looking for ways to improve yours, keep these tips in mind when thinking about how to spend your funding. You never know what might work best!

How Much Money Do Startups Need?

Starting a business is not an easy task, and you have to plan, strategize, and work hard to be successful. But there are so many different pieces of the puzzle that you need to figure out before getting started.

No matter how much potential or plans startups have, the most important thing for a person to know is that startups need capital (funds) to operate.

Although different startup industries require varying funding levels, an average seed-stage startup needs less than $2 million in initial funds. It will usually go through at least one round of financing before becoming profitable.

It’s no surprise that these numbers grow if we consider essential purchases, including marketing and advertising (preferably something like social media) and not forgetting legal expenses such as incorporation.

It’s a good starting place to break down the needs into two general categories – operations and growth.

- Operations: Between $100,000 to $400,000 for all start-up costs excluding pre-investors.

- Growth: Somewhere between 1-3 million dollars depending on scope and location of offices.

As a general rule of thumb, entrepreneurs should aim to have one month’s worth of funding available to get things started. But again, there are always exceptions depending on what type of business you get into or how willing investors are to back your project.

To calculate startup costs, one can start with fixed costs such as rent/office space, business license fees, tax information assistance, signage expenses, and accounting software that are necessary before sales begin flowing in.

Once sales are established, then adding variable costs based on revenues is straightforward. For example, it would be possible to estimate net monthly expenses by dividing gross revenue by gross margin percentage (i.e., net income).

Despite what was probably your experience with Monopoly, money is essential in startups. The number of dollars you need will depend on the type of company and how quickly you want to grow.

One thing for sure is that it’s wise to trust your gut when considering any investment, but there are a lot of things people don’t know about startups until they’re really in the thick of it.

Too many wealthy people make the mistake of investing too much at too early an age (before they understand how money works) which prevents them from learning important lessons about financial management like business expenses vs. lifestyle expenses and risk tolerance.

Startups need to be prepared for the financial risks they face. The more you know about your finances, the better off you will be when things get tough. Startups must have a strong understanding of their budgeting and cash flow management before taking on too much debt or spending any money unnecessarily.

What Do Startups Spend Their Money On?

For a startup to be successful, it has to spend money wisely. But what do startups spend their money on? They might invest in advertising, or they might hire more employees. The truth is that there are a lot of different ways for startups to spend their money.

Typically startups spend money on exploring new opportunities, providing employees with training and education, marketing their product or service – or if they’re successful – laying the groundwork for the next big thing.

Investing in these areas means they get an early understanding of what people want and where markets are changing, which will guide their product development while investing in employee training and skill-building keeps them committed to innovation over time.

Also, building a solid brand identity helps reach more customers by letting them know there’s a solution out there that can solve their problems. It also makes it easier to attract talent when you’re competing against larger companies offering competitive salaries.

Three ways startups invest their money to ensure that they grow as quickly as possible:

- Do more research on your customer base – This includes both who they are and the type of content that they are most likely to respond to. One quick area that may yield big benefits is test audiences on Facebook. You can see an instant return by changing their likes, interests, ages, locations etc on ads according to the demographic data you find out about them on Facebook.

- Hire the right people – Clearly assess what your company needs and hire accordingly. For instance, you may need experienced designers if you’re a growing startup i.e., an online clothes shop selling open-back dresses or jeans with sophisticated cuts.

- Install new computer systems – Your bank account system must be compatible with the latest industry regulations; your website must make it easy for customers to find what they’re looking for; and your accounting system needs updates in order to grow larger.

The good news is that many startups have a lot of money to spend on their marketing. Startups can leverage data analytics and customer feedback to make intelligent decisions about where they invest time and resources to get the most out of every dollar spent.

But before you start spending, take some time to think through how your customers use your product or service and find ways to reach them with content tailored specifically for them.

The bottom line is that optimizing every dollar spent can make a big difference when scaling up your company, so think strategically as you allocate funds across different communication channels with customers and prospects.

What Is The Average Seed Funding For Startups?

As an entrepreneur, you may be wondering how much funding your company will need to get started. The answer is not as simple as it seems because the amount of money required for a startup varies by industry and location.

On average, most startups are funded with about $5 million in seed capital, and this breaks down to about $1 million per year over 3-4 years or about $200,000 per year over 5-6 years.

What this means is that instead of waiting until your business becomes profitable before receiving any investment, you can fund your business throughout its growth phase so that it never has to stop growing due to a lack of funds.

Funding can be spent creating a better product, testing their assumptions, and evolving into a sustainable business.

One essential part of this process is finding out who your customer is and where they are most active online or offline; with different customers, different places come to mind if we consider the methodology behind lean startup methodology also known as agile development.

Feedback from customers will shape future adjustments and iterations, which ultimately lead to profitability.

Once all tests and surveys show that customer reactions meet expectations (of at least one segment), founders can start scaling up production, finding distribution channels, etc.

Focusing on the three most important areas for scaling up production is a way to get started:

- Head past the competition – Identify your competitors and create unique product features which they do not have, as well as improve any aspect of your product that can be optimized.

- Diversify risk – Use different sources of capital from alternative financing to a diversified distribution strategy with a private label solution that appeals to a wide range of customers.

- Empower employees through continuous learning and training– Use the best talent you have to research new products, develop contact lists for distribution agreements, meet with key stakeholders for expansion opportunities and go-to-market strategies, etc., so they are empowered in their work and prepared for what is to come in this rapid growth stage.

If you’re a startup, then the average seed funding for startups is not as high as it used to be. However, many other avenues outside of venture capital can provide startups with much-needed funds and connections to get their business going. The keyword here is “average” because every company has different needs at different stages of growth!

Pre Seed Funding VS Seed Funding

The main fundamental difference between these two funding sources is that pre-seed money comes to you before the end of the business cycle.

Pre-funding funds are typically used to experiment with an idea without signing anything or giving up ownership. On the other hand, Seed funding is for businesses that have proven themselves and are ready for growth.

They are given for someone who can solidify their idea and not because they’re entrepreneurs, which is what seed capital provides.

This higher level of investment helps with plans like raising more funds. Still, it also starts you off on a perfect note by being able to afford the talent and resources needed before developing your product or service.

The downside to the cash flow concern is that there’s no guarantee of success if your company fails later in development.

Investing in an established business does not require any paperwork because they have already proven their worth and demonstrated their commitment to following through on business deals. However, investing during the “seed” stage can be risky because you never know if they will become successful or not, so you should only support them if you are pretty sure about your decision.

Conclusion

If you’re inking of starting a business, it may be helpful to know that there are many different types of funding available for startups.

You can start with the average seed funding amount and go from there. Or if you don’t have enough money saved up yet, find out how much startup capital is needed before you get started so that your financial future isn’t dictated by someone else’s terms or expectations.

Quick Answers To Frequently Asked Questions

Difference between an angel investor and a venture capitalist?

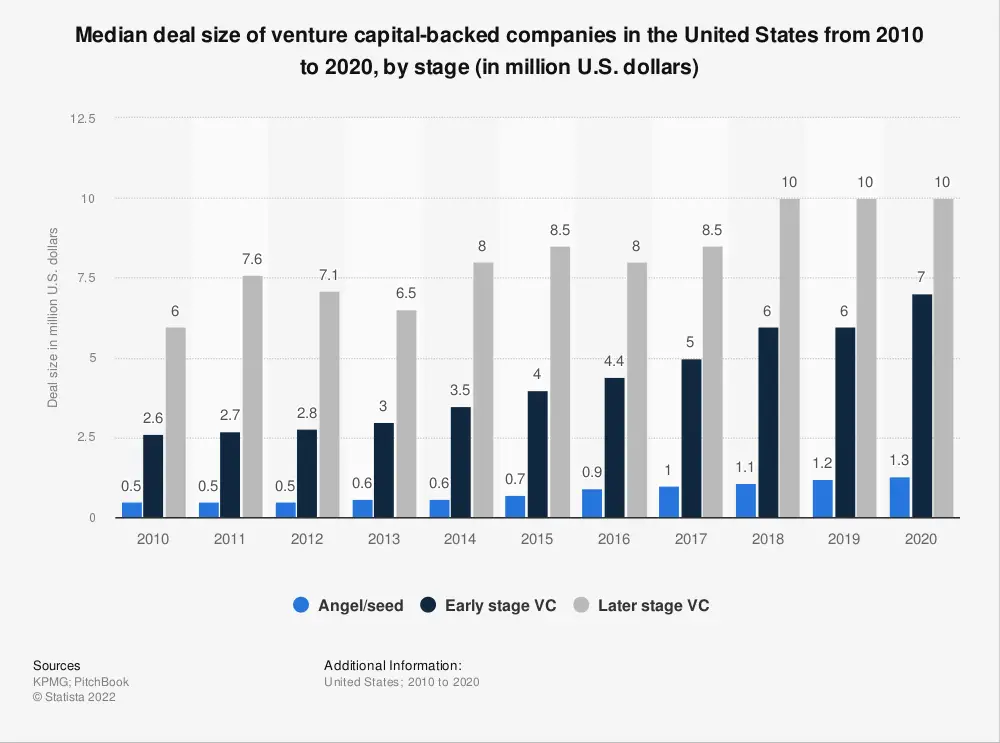

Angel Investors invest in startups with a small amount of money and less restrictive terms, whereas Venture Capitalists typically provide a large sum of money on more restrictive terms.

Can you get startup funding from a crowdfunding platform?

Yes, you can. Kickstarter is one of the most popular crowdfunding platforms out there, and it’s been used to successfully fund major projects like this one or that one.

Difference between series B funding and funding round?

Series B funding is based on the returns of the company in order to provide another round of financing. The investor will take partial ownership and will dump more money into it than they did with the initial investment they made.

Difference between venture capital funding and venture capital financing?

Generally speaking, venture capital financing is the direct injection of money into a business to provide its working capital needs. This can be done as a loan or as an equity investment. Venture capital funding is an investment in exchange for securities- usually shares of stock and not cash.

Difference between VC funding and series C funding?

One of the most important differences between VC funding and Series C funding is that Series C investors are usually more committed to the company. Their money tends not to be partial but is instead more of a single large investment for an agreed time period. They also usually have more experience in investing, which means they are potentially able to see things others might miss.

Difference between an accredited investor and a startup investor?

Investors are either accredited or non-accredited. Accredited means they have a net worth of more than $1 million dollars, excluding any shares of the company that would be purchased with the investment. Non-accredited investors can invest up to 10% of their income or annually, whichever is less. If you are not an accredited investor but are still interested in investing in startups, there are three simple steps to get non-accredited status so you can invest according to your income level!

Does every startup founder need a pitch deck?

It is my opinion that every entrepreneur needs a pitch deck. Pitch decks work well for entrepreneurs or anyone else who relies on selling their idea, product, service, or expertise to create a sustainable future they enjoy.

Does silicon valley provide equity crowdfunding?

Yes. A number of Silicon Valley firms are in the process of developing equity crowdfunding portals that will provide services necessary to enable SMEs to raise capital through online fundraising offerings without incurring debt or selling any real estate.

Are seed investors a good funding source for startup owners?

Yes. Seed investors offer the perfect type of funding for startup owners because they invest in ideas that can be revolutionary or profitable on a large scale, but not both at the same time. The more of these traits your idea has, the more likely seed investors are to invest in you.

Does a startup company only receive angel investment in the funding stage?

Startup companies may receive angel investment at any stage in the development process, but typically investors will provide an initial seed of start-up capital before the company begins generating revenue.

Does the potential investor usually want to see the marketing budget?

It depends on the potential investor. There are some investors who would prioritize revenue above anything else, so they focus on whatever has to do with money first. On the other hand, there are some investors who want to see what kind of marketing budget a business has before they decide.

Is a business loan better for early stage startups than a venture capital fund?

Being funded is the dream for an entrepreneur, whether it be through a bank loan or venture capital. A dream VC fund has more strings attached than most bank loans, but the glory of success might outweigh any negatives associated with funding.

Does the VC firm only do startup investing?

No. There are two main types of investment that a VC firm will do. Angel investing is where the company invests in early-stage startups by providing either seed or angel round funding, usually with a relatively smaller amount of money and often with the expectation of a significant return. Larger investments would be classified as venture capital investments which might be going towards scaling up a startup to what is traditionally construed as an “early-stage” start-up – late-stage or post-IPO companies may also fall into this category.

Difference between the venture capital firm and startup ecosystem?

A venture capital firm is an investment group that has the financial resources to take a lot of risk and invest in companies at their earliest stage. A startup ecosystem is an area with large numbers of startups and support services–educational, connectivity, startup programs, job-seeking networks–to create an identifiable place where entrepreneurs can thrive.