As a marketer, you know the importance of good design. You also understand that marketing is not just about words – it’s about visuals, colors, and messaging.

Tech startups with available funding will almost certainly invest in the following:

- Hire designers to create your product;

- Developers or programmers hired as full time employees or freelancers;

- Finally, having the ability to reach customers through advertising channels like Facebook or Google Adwords.

Funding is necessary for tech startups to grow their business to compete with larger companies that most likely have more resources available.

Technology is constantly evolving and growing, so it’s no surprise that many tech startups are popping up nowadays.

Why do tech startups need funding? Technological innovation! Like any other innovative activity, it takes resources. A successful tech company can’t grow without the help of investors and venture capitalists.

To begin with, what is a budget in regards to a company?

It can be defined as the money or other assets provided by investors who purchase shares to help entrepreneurs start their business venture or idea.

The funds usually come from banks, private investors, angel investors (wealthy individuals), venture capitalists (professional investment groups), government grants, and crowdfunding sites like Kickstarter.

The vast majority of startups in Silicon Valley wouldn’t exist if it weren’t for investment funding. Launching a startup requires an idea or vision and the money to turn that idea into a fully formed working product or company.

Investment capital gives the entrepreneur someplace to start from when turning this concept into reality, which is why so many tech startups look for funding early on in their lives.

Tech startups need funding to grow their business and make it profitable. The more money they get, the higher chance of success for their company.

This is why most tech startups are looking to raise funds from venture capitalists or angel investors to scale up their business and reach profitability faster than if they were self-funded by themselves or a team member without any experience investing in other companies.

Why Do Most Entrepreneurial Ventures Need To Raise Funds In Their Early Life?

Most entrepreneurial ventures need to raise funds in their early life because of the uncertainty involved.

Investors are willing to front the money if they know that they will get it all back plus a return, which means more capital for you! This is why raising funds from investors can be beneficial and help your venture grow faster.

Raising funds early on helps create a buffer while the startup gets its bearings and takes steps to ensure that it can weather problems to continue growing.

It may seem like giving away equity too soon, so how do you know when it’s time? One way is by considering other potential sources of funding before subjecting your company to outside investment. For example, if friends or family members are willing to invest, then maybe a crowdfunding campaign would be better suited than pitching investors.

If you are thinking about starting a business, then the wise move is to seek funding early. There’s no need to be discouraged as there are many ways to finance their startup with minimal risk and stress on your budget. Some of these options include bootstrapping, crowdfunding, venture capital financing, or angel investor assistance.

Where Do Entrepreneurs Most Often Raise The Very First Money Needed?

Entrepreneurs most often raise the very first money needed from friends and family. Many entrepreneurs come up with “good ideas” that they feel passionate about but lack formal training and specialized knowledge in setting out on a path towards making it a reality.

Look at where their existing social networks are (friends, relatives from childhood). You can often have better luck talking to those people and persuading them to give you startup funding for your new business project than by trying to apply for a bank loan or go in with an investor who has no connections with your social circle.

It’s essential for entrepreneurs, especially those who are just starting and have little or no capital of their own, to know where they can find funding when that initial seed investment is needed.

Angel investors might be one option if you’re looking for someone with a lot of experience in your industry or field.

Venture capitalists may be another choice because they often invest large sums into companies that show potential but don’t yet have much revenue. But it doesn’t stop there; crowdfunding sites like Kickstarter offer an excellent way for smaller businesses and individuals living on tight budgets and established brands alike to raise funds from fans without sacrificing equity.

When Should You Seek Funding For A Tech Startup?

Do not look for funding until you are ready to launch. Accepting a capital infusion before one is prepared can lead to troubles with investors, employees, or other partners down the line. Instead, focus on your idea and develop real value as quickly as possible so that when an investor does come along, they will be “wowed.” That should net better terms from an investor and result in a stronger relationship.

A startup seeking funding should be around the $1 million mark in revenue, potentially good market size. Factors like exits and growth rate for venture-backable companies also play into when to seek funding.

While it’s never too early to start taking calculated risks and testing new ideas, it is not a good time to seek investment when there are still many things that have not been proven about your business.

The best time to seek funding is when your startup has a proven product and you’ve identified key markets in which the product can be sold. You should also have enough money saved up to cover expenses for six months or more.

If this sounds like it’s too early in the process for you, that means there are some steps you need to take before seeking outside investment. Working on these first will help ensure that your business is ready and grow with an influx of cash from investors.

What Is A Key Difference Between Venture Capital And Angel Investor Financing?

Venture Capital (VC) is the funding someone invests in a company when an outside investor. This type of investment is also called equity-based financing because VCs are often offered ownership of a company in exchange for funding.

On the other hand, Angel investors are typically people who work for or near the companies they invest in and put their own money into early-stage startups to produce high returns while helping individuals and businesses grow. Unlike venture capitalists, angels usually only have enough dollars to make one or two investments at a time. And unlike VCs, Angels will most likely never take control over any of the companies they invest in, which could create conflicts of interest.

The critical differences between venture capital and angel investor financing can be summed up as follows: Venture capitalists invest in companies more likely to succeed. In contrast, those who support through an Angel may have a higher chance of failure.

The difference is best illustrated by the name “venture,” – which implies risk. Investors who take this leap should expect their investment to go down with some frequency and see greater returns when it happens.

This increased potential for reward accompanies additional risks like lack of diversification or having too much invested in one company. In contrast, angels typically involve less risk because they’re investing smaller amounts into startups than VCs do- typically $100K-$500K per round instead of multiples millions!

What Is The Primary Source Of Funding For Tech Startups?

The primary funding sources for tech startups are venture capital firms (who take equity in the company) and angel investment (which is simply about investing money).

An excellent way to improve your odds of raising capital if you’re an entrepreneur, especially if you’re new, is by using an existing relationship with someone who’s worked with VCs before.

The more established a person or firm you know in this space, the better. Going into a pitch meeting cold can be intimidating at best. Still, given enough time to prepare beforehand, making connections will help you tremendously when raising funds – it may even make the difference between success and failure.

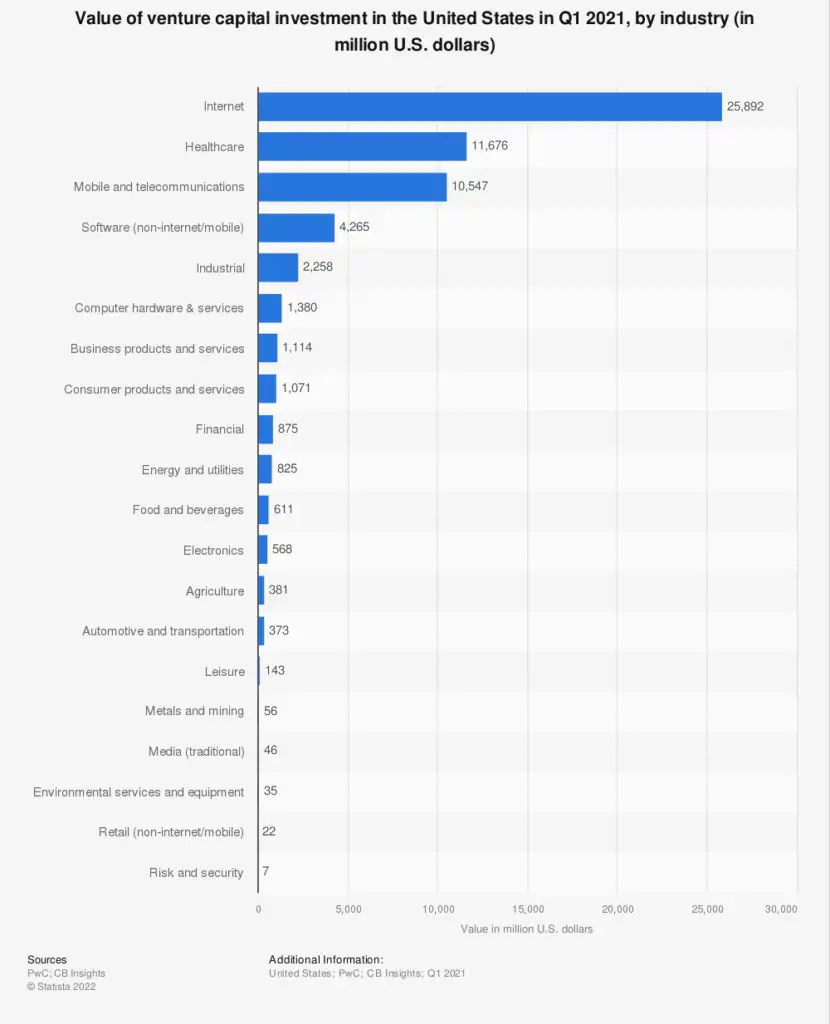

Venture capitalists invest in various industries, but life sciences, information technology services, and software publishing are the top three.

They usually have an interest or expertise in one particular industry, which drives their investment decisions.

To get access to these funds, entrepreneurs must pitch their idea to investors during what’s called a “funding round.”

Investors then decide whether they want to provide seed money based on the entrepreneur’s business plan. If accepted into this group, you will receive resources such as coaching from experts who can help manage your cash flow and marketing strategy.

Conclusion

Tech startups are unique in that they often need to raise funding from the very beginning of their life. The earlier you can find a potential investor, the more likely your company will scale up and increase with minimal risk for failure or setbacks.

To summarize, most entrepreneurs need to raise funds in their early life because they are starting a new business. The first money raised is usually by friends and family or investors who believe in the entrepreneur’s idea.

Equity investments can be risky for both parties involved, so you should only pursue this option if it feels right with your venture. Before raising any more capital, take time to make sure that you have enough cash on hand to keep things afloat until revenue starts coming in from sales of your product or service. If not, try looking into other sources like loans and grants before taking an equity investment route.

Glossary

A funding round generally refers to the process by which investors provide money for a company headed towards an eventual project or product launch. Funding rounds typically last 3-6 months, can range in size from tens of thousands to millions of dollars, and are characterized by which type of investor is providing the funds; angel investors, institutional venture capitalists (VCs), or other private sources.

Seed funding is investment capital that helps startups and small businesses get started with minimal financial risk.

A startup investor is usually an individual or a group of people who provide capital to new, growing businesses. However, they’re not something you would want to develop a relationship with without doing the research first because the primary goal of startup investing is financial return.

Startup founders are entrepreneurs who start a new business with the hope of creating and building a startup company’s enterprise.

A startup accelerator is a program that provides resources to help grow early-stage businesses. There’s usually an application process and a selection committee that decides if the company should participate in the program. The startup will often have lawyers, accountants, and other experts provide helpful expertise and access to databases of potential customers or investors who can give feedback on their product or idea.

A venture capitalist typically invests in the earliest stages to help a new company provide growth capital and expertise that they may not have access to otherwise. From the investments’ perspective, the venture capital fund is advantageous because the companies are less liquid at this stage and hence will trade at a lower valuation. But as they grow, VCs will be rewarded with cash-on-cash returns that can range from 20% to 100% per annum for small stakes in innovative startups.

A venture capital firm (VC firm) is a private investment company that pools together money from outside investors and invests it into startup and early-stage companies. Venture capital funding typically supports new or developing industries like artificial intelligence or virtual reality.

A funding source is an entity that invests in a business or provides a business loan, granting external funding and resources for its operations. The investors typically receive shares of the company’s stock, which entitles them to economic rights such as voting rights and the right to trade these shares on an exchange.

The equity crowdfunding process is the act of raising money through small, individual contributions. A company decides to use “equity” or ownership shares as opposed to debt or revenue-based (e.g., “pre-sales”) claims to fund startup company costs and raise capital by bypassing the traditional venture capital and angel investor route.

Lean startup is a business strategy that compels entrepreneurs to use data-driven and design-oriented new product development methods. The most important part of lean startup, and the subject on which most people have heard, is “get out of the building.” It means that entrepreneurs need to go talk with potential customers (often called a “customer development team”) as early in their process as possible.

The startup ecosystem is composed of the actions, interactions, and relationships that occur during a startup’s formation.

The y combinator is a company that provides seed money, advice, or connections to successful entrepreneurs in exchange for equity. The point of the arrangement is to provide an opportunity for promising startups to get squeezed into Silicon Valley’s over-booked, hypercompetitive innovation labs.

The VC investment is a business in which venture capitalists offer entrepreneurs emerging, promising ideas and products that can be successful startups.

A crowdfunding platform is a reward-based funding website that allows people to contribute money to a project deemed worthy enough for investment. Venture funding has helped millions of people finance their dreams.

IPO stands for Initial Public Offering. IPO is a new way of conducting public offerings. Companies like Spotify and Warby Parker, who have historically been founded and led by men, are turning to the idea of IPO’s following more women-led startups to equity raises.

Angel funding is an investment of money by an individual or group into a company with the idea that they will benefit from the success of that company. A VC fund can be beautiful to first-time entrepreneurs looking at a funding option to help with their startup costs, and VC funding can help with startup costs, especially for women-led startups.