In an ever-changing business landscape, it’s difficult for companies to survive. The average company lifespan is only 27 years, and the number of bankruptcies every year continues to rise.

What can you do if your company isn’t profitable? How do unprofitable companies survive?

The answer is simple: innovation. Every organization needs a way to stay relevant in today’s competitive marketplace. This means investing in new products and services to attract customers and keep them coming back for more. To learn how you can innovate your product or service offerings, read on!

In today’s competitive marketplace, the only way to keep up with the latest trends is to innovate. This can be challenging for many marketers and entrepreneurs because they’re unsure how to implement new ideas into their business model without sacrificing what has already been working.

Thankfully, there are ways you can start innovating your product or service offerings in a way that won’t break your bank account.

Here are three tips for getting started:

1) Consider your customers’ needs and preferences: Identity what’s important to them, such as price point, convenience, or environmental friendliness. Then consider how that might impact the way they use your products or services.

Finally, brainstorm ideas on how you could offer new features and benefits that would make their lives easier in some way without sacrificing quality–or even improve it!

2) Get creative with design – Designing something completely new can seem intimidating, but it doesn’t have to be! Try using some popular fonts or colors from other companies’ logos and see if people like them on Facebook, Twitter, Pinterest, etc., then make changes accordingly based on reactions from followers.

3) Monitor data and feedback from customers to get insights on what they want in terms of products and services.

A company can lose money, innovate, and maintain its financial health. A company with declining margins may decide that the value is in innovation rather than profits.

In this scenario, they will not only survive but grow up to 50% faster by leveraging innovation opportunities presented by disruptive forces such as iPhone 6 or robotics.

Companies often reinvest profits from profitable lines of business into sustaining themselves while waiting until innovations come online, which provide increasing returns on investment and allow them again to become so good.

The “exit strategy” for a startup is called innovation. This does not mean that the company has to be endlessly churning out new products and services to pay the bills before it exits. Still, instead, it simply means they are continually looking for (and focusing their research on) new ways of turning their customer base into more profitable projects.

How Long Can A Company Stay Unprofitable?

The business world is constantly changing and evolving. One of the most significant factors in a company’s success or failure is profitability, meaning that it can generate enough revenue to cover its costs and expenses.

Achieving this goal may not be as simple as it seems, but most companies can stay profitable for at least a year before they have to start cutting back on expenses or looking for new ways to make money. The longer a company stays unprofitable, the less likely it will be able to turn things around.

Research has shown that one’s lifespan as an unprofitable company is between eight and ten years (on average).

One often-overlooked trend in the global economy is how rapidly producers of goods, specifically technology companies, are being replaced by innovators. Disruption may sound like a bad thing for established companies, but it’s just a natural process.

Innovation is happening all the time – there are more new products on the market than before. So when free or cheap copies of existing solutions appear on the market, it often spells death for legacy players like Kodak or Blackberry.

A company could stay unprofitable for an indefinite time, but eventually, it will reach a point where its cash reserves have been exhausted. Usually, this is when customer demand and revenue streams dry up.

This might ultimately be due to external factors (e.g., recession) or poor management decisions (e.g., investing in the wrong markets). With innovation, the company can find new ways of generating profit even if sales are flat or decline dramatically over time as people change their tastes.

It’s important to note that companies with existing divisions may need subsidies from their profitable arm(s) to fund their loss-generating one(s). Ultimately though, if they don’t cut losses by reducing investment into the declining component (s), they will fail as a whole.

Why Are Unprofitable Companies Valuable?

Unprofitable companies are valuable for one simple reason: they have profitable customers. If these companies can figure out how to get their current customers to buy more or find new customers who will pay the same price as their current ones, they will become profitable.

Innovation is the only way a company can become profitable.

To increase profits, many companies invent new products or do research and development work. These investments don’t pay off in the short term, but they are necessary for long-term success (profitability).

Innovators create a positive ROI by using information about their market environment that others don’t have access to. In other words, by focusing primarily on innovation and innovation alone, an unprofitable company will eventually be worth quite a lot of money!

If you’re a startup with innovative ideas and don’t have any revenue, investors will be afraid to invest in your opinion because it’s not proven.

You may have huge potential, but if you can’t demonstrate that and convince investors, they’ll stick to businesses with low risk.

The truth is that business innovation is critical – there are still many industries left untouched by technology.

Steve Jobs said it best when he said, “we’ve always been shameless about stealing great ideas.”

So the value of unprofitable companies doesn’t come from making loads of money for shareholders; it comes from innovation that leads to lucrative revenue streams down the road.

Why Do So Many Successful Startups Not Make A Profit?

With the rise of new technologies and the internet, an increasing number of companies are becoming successful but not profitable.

It’s estimated that 70% of startups are unprofitable within two years after founding. These companies have innovative products or services, yet they still fail to profit and eventually close up shop.

The question begs: why? Well, for starters, startups take on more risk than established businesses do because they don’t have any previous data on which to base their decisions.

They also often lack experience in their chosen field and access to capital and resources necessary to grow their business exponentially as more giant corporations can afford – this means less revenue coming in overall while costs continue at an increased rate.

Tech innovation is a booming industry and has seen tremendous growth in recent years. Some companies have made the transition from fledgling startups to big businesses, while others remain more niche-focused.

Entrepreneurs often start with the mindset of where to innovate and not how to profit, but one cannot survive without the other. Cash flow is crucial for a business – it’s the management of cash that enables a company to grow.

I think successful entrepreneurs have a natural drive, and they all want to see their ideas through, but more importantly – they want them to succeed eventually as financially viable enterprises.

So most of these people are capitalizing on using market realities such as saturation tendering or niche markets exploiting.

Niche markets can be highly profitable and rewarding to exploit for innovative enterprises – but they have their risks.

If there are enough aspects of the niche that can be exploited, then no matter how small it may seem on the surface, there’s hope for progress.

It’s essential to assess these aspects and see what could make them innovative to develop new products or services that haven’t been done before.

Whatever is left over after this assessment should probably be outsourced. It likely won’t make a difference to who gets beaten out of the market because they didn’t innovate enough.

Innovation is critical here – without innovation, “real innovation” in such a situation becomes impossible since every project would reiterate something pre-existing.

Can You Write Off A Failed Business?

Many people have heard the term “write-off” before but don’t know what it means. A write-off is a deduction that an individual or business can take when trying to reduce their taxable income. This deduction can be for any number of things, including capital expenditures, repairs, and depreciation. To qualify as a write-off in the United States, you must keep detailed records of your expenses and complete IRS Form 4562 (Depreciation and Amortization).

Which business expenses are deductible depends on several factors, including the type of business you operate, what you do with your products or equipment after they have become worthless, and whether or not you are an individual who does not actively participate in the operation of a family-owned farm, another closely held profit-seeking organization.

In the United States, you can write off a failed business under certain circumstances from either personal income taxes (via loss carryover deductions) or self-employment taxes (likewise via unrestricted net operating losses).

Successful net operating losses may offset income from other sources without limit. Hence a tiny profitable farming activity that is carried on to hold title to land that has significantly appreciated can reduce unrelated income tax liability.

Whether or not any given accountant will agree with you is another question, and of course, there’s always the risk that an inspector might look at your return. It might just be better for most people to use any tax refund money they get as seed money for their next venture instead of cashing in on losses from an old one.

How Important Is Business Image Or Identity

The way its customers and potential customers perceive a business is significant, and a good image of the company will attract more clients. You can create this image with the help of branding, marketing, advertising, and other activities designed to influence people’s perceptions.

A company’s business image or identity is the first impression that its name, logo, and other visual elements give a potential customer.

The importance of this presentation cannot be overstated, as it will shape how you are perceived in the marketplace and what opportunities you may have for increased visibility.

Image is everything in business. It takes more than a product to make it successful because people may not buy an item for one reason or another, but they will buy anything with the right image on the packaging – even if it’s not something they need.

There are many images, and companies have to consider which kind of image fits them best carefully. Looking at competitors is very vital to ensure you’re going with the best possible fit as well.

Businesses are demanding higher quality in their products and services, so the need for an identity that exudes the same value level is becoming ever more critical.

Identity defines a company’s brand personality, yet it is often overlooked when planning marketing strategies. Good design can significantly impact how customers feel about your business and, if done well, will allow them to spread positive word-of-mouth about your company to grow awareness of your company even further.

Sending defined messages through symbols and graphics has always been fundamental to successful branding because it establishes familiarity between the customer and the brand and influences what people think about the product or service without even seeing it first hand.

Conclusion

If you’re a company owner who is struggling to make your business profitable, there are ways that you can remain afloat.

Make sure to keep an eye on the budget and cut unnecessary expenses where possible.

Find creative solutions for generating revenue by identifying new opportunities in different market segments or creating side businesses that will help fund your primary business idea while it grows to profitability.

Your unprofitable company may be valuable as long as it has growth potential and continues making progress towards its goals, even if this means taking a break from profit-making activities until these efforts bear fruit.

When considering whether to write off a failed business, think about what went wrong with the venture before deciding how much the investment should go into writing down losses versus trying again.

Glossary

Zombie firms are small businesses facing near-certain pending ceasing of existence and who have a slim chance (usually up to 33% of success) of surviving in the next 12 months. A zombie company is a small business still alive, but it’s close to death. It may be chronically ill, or maybe it just went through a disaster… but it’s struggling with such crippling debts that there seems no way out.

A zombie share is a stock price that does not react to any stocks market trends. For example, if a tech company starts slipping and a social media company starts rising, our hypothetical investor would only see their tech company shares maintain their value. The same is true when the reverse happens.

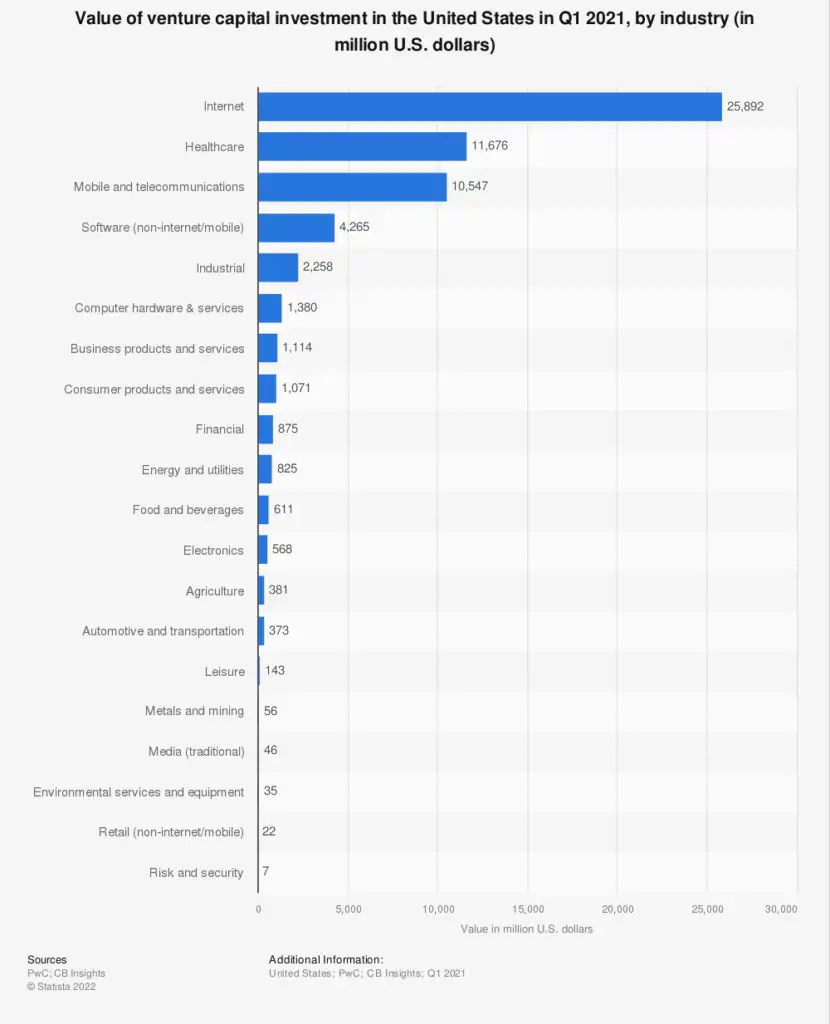

A venture capitalist is someone who invests money in a business with the hopes of helping it become successful enough to provide an opportunity for a profitable return on investment.

Unprofitable startup (or unprofitable business) is a problem for both the businesses themselves and the economy. For instance, if these unprofitable startups cannot recoup their investments or show enough potential to raise more capital, they will eventually be forced to shut down, which causes an increase in unemployment and a decrease in productivity level for those employing these companies.

Gross profit is the total revenue from all sources minus the cost of goods sold and operating expenses. Gross profit is one measure of how much income remains once subtracting an enterprise’s fees during a given period.

Net loss is the bottom line of a financial statement, and it’s calculated by adding up all the losses and subtracting them from the total revenue.

Nominal interest rates are the interest rates used by a lender or financial institution to calculate how much money a borrower must pay back after receiving credit.

Productivity growth is the ratio of economic output to total hours worked.

Wall Street is a district in New York City, named after the Dutch settlers built there, near this spot. It has traditionally been associated with international trade, the stock market, and finance.

Silicon Valley is an area of Northern California south of the San Francisco Bay and roughly centered above Palo Alto. The name came from the materials frequently used in its microchip manufacturing.

Venture capital is a style of investment strategy where the investor seeks to profit from long-term growth in both firm’s revenues and market value.

The term unprofitable ‘unicorns’ refer to companies that don’t turn profits but have a lot of public investment. An unprofitable unicorn has more than $1 billion in venture funding and isn’t generating profit.

A cash flow statement is a financial statement that outlines the sources and uses of cash within an organization over a specific period, typically monthly.

A positive cash flow is an income statement item that measures the amount of cash a business generates.

An IPO is an Initial Public Offering, where a group of people invests in a company with the idea that they will get a return on investment.

A listed company is a company that has its shares traded on a public stock market, the one most people think of being the New York Stock Exchange. Listed in this sense means it’s included as part of a published index, for example, the S&P 500 Index or Dow Jones Industrial Average (DJIA). Most publicly traded companies are also listed companies but not all.

Market share is a straightforward measure of a company’s profitability. Many people who want to know this information stop there, but some aspects are more challenging to quantify than others. For example, market share can be broken down by either unit sold or sales dollars achieved in the marketplace. The challenge with reporting sales dollars earned in the market is how it deals with taxes and changes in prices over time instead of unit volume.

An entrepreneur is a person who has the drive and determination to start their own business, usually without any outside resources like loans or investors. A small business owner or retailer can also be an entrepreneur who starts from nothing and builds up an enterprise with ambitions to grow it into something meaningful.

An income statement is a document from which an entity’s total revenues and expenses are derived.

Cash inflows refer to the monies received by an institution or a person from the disbursement of project-related expenditures.

A business valuation is a process of estimating and communicating (assigning a monetary value to) the worth of a privately or publicly held company, land, building, or other assets.

A chief executive is someone who has the final say over the day-to-day operations of a company.

A central bank is a bank that offers services all around the country. The government usually oversees them regulates how much currency is available for circulation, although some countries have many different banks that fall into this category.