As an entrepreneur, you have to be willing to negotiate equity in a startup. Many factors go into how much equity you should ask for and what a fair offer is.

I just got back from an entrepreneur conference in San Francisco, and I’m excited to share with you what I learned. One of the most impactful talks was about negotiating equity in a startup.

The speaker, Jennifer Fonstad, gave many great tips for negotiating with your cofounders on equity distribution.

For example, she says that it’s essential to make sure everyone is valued equally so that there are no hard feelings when one founder leaves the company or if they want more compensation than another founder.

She also said not to be afraid of asking for too much because you may end up getting less than you wanted anyways!

There are several factors to consider in your negotiations for equity ownership.

For startups, you must evaluate the company’s present and future value. The more uncertain the path forward, the lower the present value and, therefore, the percentage of equity offered by compensation.

Equity percentages also depend on how popular or successful a new service or product will be each year after its release. Equity percentages at this stage usually include growth potential in a venture capital firm’s investment strategy.

Additional factors to account for include location-country comparisons, gender inequality, cultural background, and ethnicity. When determining what percentage an individual deserves in a company, they have played a significant role in developing their ideas or skillset.

Examples of what to do when you get a good offer from a company.

- Assess the opportunity and decide for yourself if this is something you really want to do, or not. If so, great! Proceed to point 2 below.

- If it’s not, kindly decline their offer and let them know you’re going in another direction instead. Nowhere is it written that an investor has the right to tie up your services with an unreasonably low compensation package. You can negotiate equity on your terms too–financing negotiations are typically no different than any other type of negotiation.

- Make sure that both parties have been clear about what’s been agreed on from the start.

Negotiating equity in a startup is not easy. Very few people would willingly volunteer the equity stake they have built up at work or another company to go all-in on the risk of starting something new.

There are, however, some ways you can get more leverage in your situation:

- Draw up an agreement outlining the shares, vesting schemes and any additional payments you want to make for services rendered to the company.

- Document what was said and agreed upon (or paraphrase it, if that sounds better).

- Give them a copy of what you wrote and ask for their signature agreeing to all terms stated in the document – don’t forge someone’s signature!

Equity is a valuable reward and starting point for any new business. If you and your co-founders are not reaching an agreement, here’s how to handle it in the most productive way possible. The key is good communication so that everyone feels like they’re being respected and heard. You can do this by setting clear expectations about what each person wants out of the relationship from day 1, then periodically revisiting those goals as time goes on.

Looking For Targeted Leads?

Find accurate B2B contact information for targeted marketing. Close more deals and start more conversations.

How To Negotiate Equity In A Late Stage Startup

It’s never too early to start thinking about how you will negotiate your equity in a late-stage startup.

The way you negotiate can have implications on the amount of equity you end up with and the type of company it is. When dealing with equity, here are some things that may be helpful:

- Be informed about what types of companies exist and what kind fits best with your interests and skillsets.

- Research founders who have sold shares before and see what they did when negotiating for their share in the company.

- Think about things like whether or not there is a cap on how many shares can be issued, for example, if there is a liquidity event coming up soon (like an IPO).

An equity offering should be defined as a percentage of the company’s total shares and other assets. But in most cases, startups are valued based on their future success, making the valuation uncertain until the company has matured.

The prospective founder will need to agree to make an investment up front with little or no guarantee of payoff or receive a significant salary that is paid monthly upfront.

Some variations include receiving a percentage of any profits, stock options at varying prices, receiving stocks at nominal value plus future proceeds when they are sold for more, licensing fees rather than equity stakes in the company, etc., all very specific to each startup.

Typically, there are three main ways that founders come to the table with equity in a company- deferring compensation, financing, and sweat equity.

Deferring compensation is self-explanatory, and a founder will get paid their base salary instead of an equity stake in the company.

The tradeoff is that they won’t have any shares and miss out on any future growth or financial upside of having stock in the company.

When it comes to sweat equity, what this means is that if someone has put hundreds of hours into building up a side project, for example, then they might have some ownership over its intellectual property by how many hours they’ve contributed to the development or design of an initial prototype or product.

If you are an employee at a late-stage startup with equity, the value of your shares may increase or decrease depending on how well that company is doing.

Employees should carefully consider stock options to determine whether they want to stay in their current position and cash out when it reaches its peak.

If you do not have any stock options yet, it might be worth considering getting some before joining a late-stage startup, so if it does succeed, you will get more benefits for yourself than just salary alone.

The best thing about this type of compensation is that there are no guarantees that the company will succeed – which means both parties can win big without risking too much.

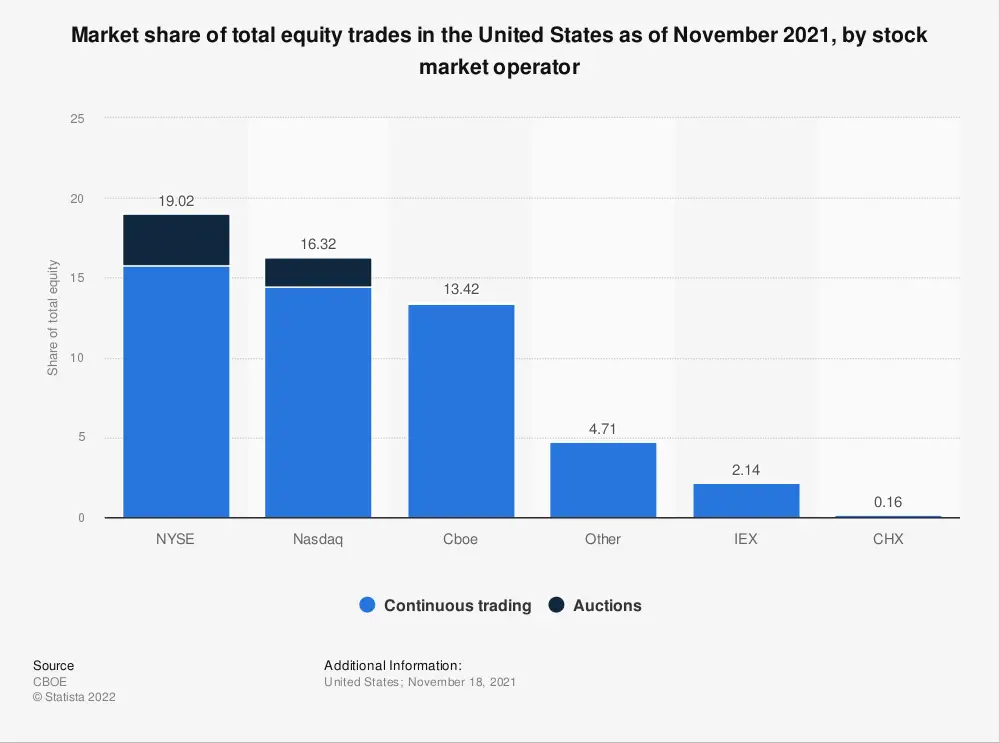

Market Share Of Total Equity Trades In The United States

What Is Equity In A Startup?

A startup is a company in the early stages of development, and equity is what makes it unique.

Equity can be defined as shares in a company given to its founders and partners. Founders may offer equity to investors or employees for compensation or incentives. The process of acquiring equity in an early-stage startup is not like buying stocks on the stock market because there are many unknowns about how much value it will have when launched.

To put it simply, equity in a startup is the percentage of the company that an investor owns. The equity might be given for cash (commonly known as Preferred Stock) or based on your contributions to the company (Common Stock).

Equity in a startup can be structured in many ways and figured out by professional investors and attorneys through negotiation.

Startup equity is usually structured as small amounts of common stock. Founders may also take options that represent the right to purchase more shares at a later date for a specified price, generally exercisable after an initial public offering or other liquidity events.

This can be done by converting one’s holdings to income – taxed – or capital gains – tax-free should the company generate revenue beyond expectations.

When these incentives are not present, founders will typically receive limited convertible debt. They only take ownership if another investor agrees to buy them out or buy their shares upon exit for an agreed-upon price.

Three ways equity is structured in a startup:

- Convertible debt usually converts at a conversion price close to the equity cap. Consider it an IOU of sorts.

- Preferred shares that pay dividends, but can’t deduct losses or hold board seats over common stockholders’ heads.

- Common stock that has no rights when things go south and sometimes pays no dividends.

One might call this structure “unimpressive.” However, when considering the entire package offered in your question – protection against dilution with an investment round – equity is pretty attractive.

The point of equity in a startup is to provide the founder with an ownership stake. In return, they can use this for many things, such as getting funding and even selling their company at some point down the line.

Equity can also be used by investors who contribute capital and labor to a company that eventually produces revenue streams or profit.

This means that if you want to start your own business but don’t have any money, there’s no need to worry about not having enough funds because all you’ll need is someone willing to invest financially in your idea.

How Much Equity Should I Ask When Joining A Startup?

It varies quite a bit depending on what you’re offering, the stage of the company, and what other people are being shown.

If you have significant experience in your field, it’s best to come in as non-equity. This protects both parties’ interests – it empowers you to walk away without wasting any time or money out of pocket while watching the startup from poor investments.

If you are looking for equity, the best way is to figure out an equity percentage that works for both yourself and the founders is by comparing the value they attribute to your contribution relative to their contributions, not by how much work goes into a project (although sometimes your role and theirs overlaps) or what level of responsibility you have – all these things shift over time.

Many would recommend asking for around fifteen to twenty percent of the company. If you’re joining with no substantial prior experience in the field, five to ten percent is plenty.

Some investors prefer to invest in individuals because it allows them to control if something goes wrong. Others are more likely to give you an easier time when you come in with a less ambitious number because your wealth cannot be realized through shorting or other more significant risks. Ultimately, these matters are best left for negotiation between the company and the individual concerned.

The Typical Startup Equity Structure

There is a lot of debate as to the “best” equity structure for a startup. The reality is that there’s no one best way, as it depends on what you want from your employees and what you know about them going into the process.

A lot of startups make a similar “equity split” in both stock and cash. The equity split is usually 75% for the co-founders, 10% to 20% for an angel investor or group of investors, and then often 1 to 5% goes to the company’s advisors.

Sometimes there will also be a percentage set aside for future employees. In other words, when it comes time to “exit” the startup (sell the company), there should be three times as much money going towards investors than going towards early employees!

As a general rule, the more money you have to offer as an equity stakeholder, the less percentage of the total equity stake you need. Conversely, the smaller your investment and financial contribution to a company before it’s profitable, the larger your share of total equity should be.

A simple option would be for you to keep your primary equity in the company. You can later figure out which people are essential to the company and reward them with dividends by their level of responsibility.

If you introduce a shareholder model, they will want a cut of any money outside of taxes made off share trades or anything else that has to do with shares in the company.

This prevents investors from profiting off an early investment in selling shares when it becomes profitable after what could’ve been decades of challenging work pushing the business forward without earning back their original investment.

Equity is a critical component in the success of any company. It’s essential to understand how equity works and what it means for your business or startup.

How To Divide Equity To Startup Founders, Advisors and Employees

Equity in a startup company is usually determined by the percentage of the ownership individuals initially invest in it.

The founders should retain just over 50% of the company. The equity split among advisors can vary, but 10% to 20% is fair. And the remaining 30% should be allocated among employees depending on their role in the business.

Employees who might leave after a year or so or have less job security receive fewer shares than long-term employees with high job security.

Equity in startups often comes with strings attached – there may be an agreement to “roll-up” stock options into the entity when granted, which prevents them from becoming liquid for a couple of years; terminated employees may forfeit unvested options, and officers and directors of startup companies generally will not receive any equity compensation at all (unless they sign some kind agreement).

It is important to remember that while equity is an excellent instrument for properly incentivized founders and key employees, it doesn’t make a good reward for low-skilled labor or middle management.

For instance, if you had one guy working in marketing who could develop some visual brochures but whose only real skill was boring everyone at company parties, it might not be worth rewarding him with too large of an equity stake.

Conclusion

Equity is a complicated thing to understand, even for seasoned entrepreneurs. You have to know how much equity should be allotted per each stakeholder in your company and how to divide the pie so that everyone feels like they are pretty compensated and incentivized.

The key to negotiating equity in a startup is understanding that you are not just bargaining for yourself. Equity should be shared with all the founders, advisors, and employees of your company so they can share in its success.

Suppose you’re looking at joining an early-stage startup. In that case, it’s essential to understand how much equity will get divided between founders, advisors, or other stakeholders before you agree on anything or sign any agreements.

You want to make sure everyone has an opportunity to benefit from the company’s growth while also considering what kind of value each person brings.

In contrast, if you want to join a late-stage company as an employee, there can be some benefits to getting less stock but having higher voting power on important decisions that affect the business going forward.

Quick Answers To Frequently Asked Questions

What is the difference between the strike price and founder equity?

The strike price is the value assigned to each share of stock. For example, if there are ten shares for every employee, each one has a strike price of $50. Suppose the number given for founder equity does not involve an exact dollar “strike” or founder salary. In that case, this is usually about how large an investor’s percentage of their company is before any options are exercised.

Is there a liquidation preference in the equity offer?

Yes. The liquidation preference hierarchy works as follows: Debt, preferred shareholders, common shareholders. So if a company is liquidated after defaulting on its debt and the proceeds from that process are used to pay off the debt, then whatever remains will go towards paying preferred stockholders. If anything is left over from paying the preferred stockholders, it will be paid out to common shareholders.

What does it mean to have a vesting schedule in a private company?

Companies are motivated to strike a balance between aligning the interests of their employees with the company’s needs while also being careful not to put all their eggs in one basket. A common way to do this is through vesting schedules, which set out how quickly employees gain access to assets they receive from their share awards.

Can a startup founder also receive employee equity?

Yes, but it depends on the company’s size and who or if they have a founder that is or will be working at the company.

What’s the difference between restricted stock and vested shares?

Restricted stock can not be sold until vested, whereas vested shares are bought in the open market and may be traded immediately.

Can a VC firm have a cap table?

Yes. VC firms are small corporations that have the capital they invested in maintaining their companies. Believers in the company’s vision must be willing to support it by investing or loaning money to expand further the company they believe in.

How long is the vesting period for startup funding?

A vesting period freezes the portion of stock given to an employee for a given amount of time, typically four years. “Vesting” in this sense means putting something aside and saving it for later use. The idea behind the vesting period is that employees will feel incentivized to stay with their company until they get vested because if they quit before then, they’ll give up any unvested shares.

Does the co founder equity include the signing bonus?

The signing bonus is a different type of equity, which you should have discussed with your co-founders before beginning discussions about equity splits. To avoid any confusion over this matter in the future, always bring the subject up when it comes to negotiating terms.

Can an equity package have an option grant?

Yes. In the more formal setup, some companies use an equity exercise right as a long-term incentive or retention tool to be exercised at or after vesting.

What is a cash compensation term sheet?

A cash compensation term sheet is an outline of the fundamental aspects of an employment agreement. The term sheet often includes the amount and paid, what is to be compensated (salary, bonus), any deductions, vacations days, etc. It does not have any potential benefits offered by the company.

Can an equity grant have equal equity splits?

Equity grants can have equal equity splits, but because each company has different needs and values, it is difficult to generalize the type of equity splits companies use.

Can a startup employee increase company’s valuation?

What determines company valuation? A company’s valuation is partly determined by its financials. Still, it’s also based on how many customers it has, who the customers’ competitors are, what stage in the product lifecycle the business is in.

Does the startup company valuation need to be a fair market value?

No. A fair market valuation, which is the price someone would pay for a free and open trade company, can be considered too much if the seller has other assets to sell. This type of valuation is only used when comparing companies with similar types of investments available.

What is a convertible note for a startup?

A convertible note is a debt instrument that converts into equity when the company ceases to be a private entity. Startups often use convertible notes because they don’t have the funds on hand to pay for financing upfront, and this also ensures some return if investors decide not to invest further in a said startup.