When looking at technology and the future, startups inevitably feature large. There have been so many high-profile companies that started as a single person, and the riches that can be made from a single idea seem out of perspective, so are startups just a trend?

Startups are going to continue to exist, but the current expectation around technology-based startups is overblown. You can be sure that the next big idea that revolutionizes the world will be from a startup that you’ve not heard of yet.

I’ll take you through what startups are and how they can be so successful. We’ll also look at the current issues with startups and the unsustainable nature of the current startup environment.

What Is the Percentage of Startups That Succeed?

Startups are just businesses, usually based around an entrepreneur looking to bring a new product or service to market.

Almost as long as we have had market capitalism, we have had entrepreneurs trying to start new businesses and be the next success story. Startups are nothing new; however, the rise of the internet and technology means the scale is quite different.

There are some more academic definitions of startups as well. One of the more exciting definitions is from Steve Blank, which is that a startup is a temporary organization designed to look for a business model that is repeatable and scalable.

This is distinct from a company, which is what the incumbent firms are referred to. A company, as Blank states, is a permanent organization designed to execute a business model that is repeatable and scalable.

There are at least ten times as many that go under for all the success stories that you hear about. Indeed, only 10% of startups will make it, and 50% won’t make it past the first five years.

Startups come in so many different versions and use different approaches that it is hard to classify what a startup is. However, in the early stages, they are likely to have little revenue coming in. The idea or concept may be strong, but finding customers is challenging.

Startups will have an idea that they have to develop, test, produce, and market. Many startups will be home businesses that get developed into something bigger. Others may attract the interest of an investor after a solid business plan.

In the end, the reality is that getting a business off the ground and successful is very hard, and most don’t make it.

The Spheres Of Startups

The largest sector for startups is in what is referred to as fintech, a portmanteau of finance and technology. Of course, Paypal is one of the original fintech startups, but with the rise in blockchain technologies and ever-improving software, fintech is a vast industry.

Some of the dominating names in fintech include Stripe, and the sector accounts for almost 10% of the startup industry.

Life sciences and healthcare is the next significant sector, coming in at 6.8%. The rise in health screening and data-based healthcare enabled via simple screening, and Artificial Intelligence has tipped this sector to bring the next significant paradigm shift.

There have been pilots of rapid DNA testing that could highlight potential allergies or diseases, with a drone then dispatched with pharmaceutical medicine to treat it. The following startup to deliver such a healthcare revolution could save thousands of preventable deaths.

Whatever the next big thing is, the resultant business empire could be today’s unicorn company.

What Are Unicorn Companies?

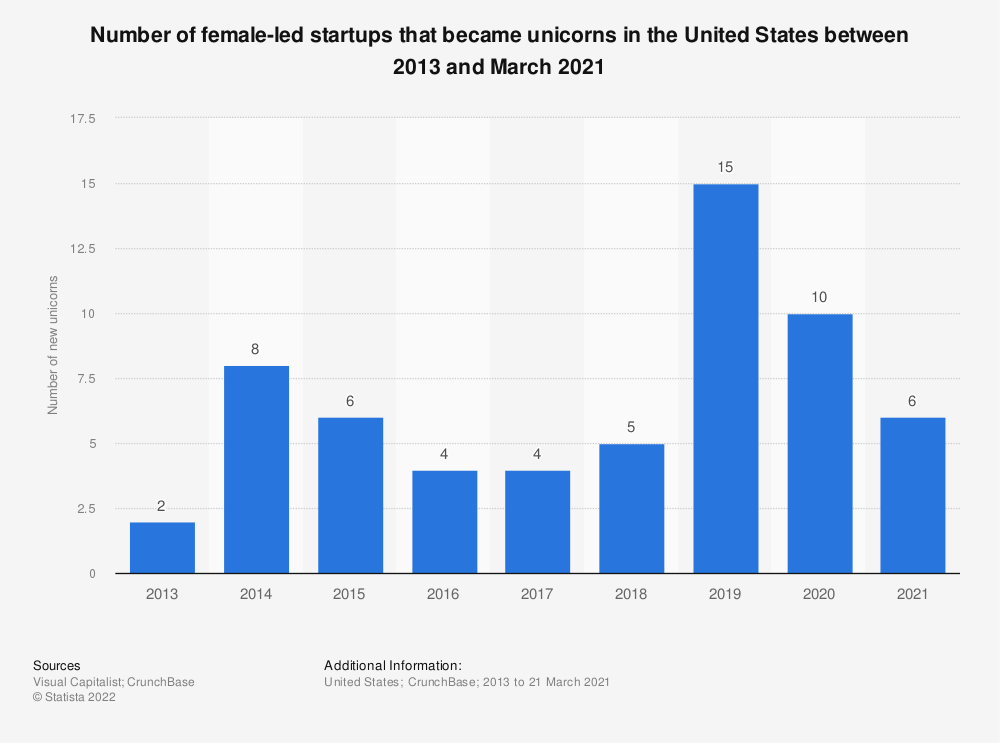

A unicorn is a startup company valued at over $1 billion. The selection of the symbol of a unicorn should be enough to tell you how rare such occurrences are.

Only 1% of startups that reach seed round funding ever get to unicorn status.

The term was made famous by venture capitalist Aileen Lee; however, venture capital is not the only way to fund a startup.

Funding Startups

The billion-dollar valuations and IPOs are not possible for every startup. Getting the seed money to get your project off the ground can be next to impossible when you haven’t proved if your business will be profitable or not.

Like most businesses, startups often look to family and friends to get some initial cash to develop an idea. A prototype can constantly be developed with a few thousand, at least enough to get some investors interested.

Crowdfunding has been made more accessible with the rise in online platforms, themselves startups. Kickstarter, Patreon, and Indiegogo are just a few examples that can be used to put your idea in front of many and get the initial funds you need.

Even a slickly produced video shared on social media could draw millions of eyeballs to your product.

After that, there are the usual funding sources available if you have some collateral.

The next step up involves typically building connections with professional investors. This can be via networking with an angel investor group. Angel investors will look to get into startups at the risky seed money stage, as picking right means enormous windfalls.

Angel investors will also be able to provide expertise and further networking opportunities. They are sophisticated in business and look to grow their fortunes by bringing their unique skills to new projects. Properly leveraging this is the key to a successful startup.

A venture capital firm is a company that acts as a vehicle to develop startup businesses. However, it gets equity in the startup it funds and will impose a management team in many instances.

The operation of a venture capital firm is very similar to other institutional investors. They have a pool of funds from several investors. They are very selective about what startups they invest in, often requiring a majority of investors to agree on a particular course of action.

Venture capital is tough to obtain and starts in the millions. In the end, venture capital firms are looking for the next big startup, but certain startup networking events or even the firm’s website can be used to contact them directly.

There is not much chance to get venture capital backing, and recent numbers show that approximately 0.05% of startups successfully get such investment.

How Are Startups Able To Be So Successful?

Overheads and costs are a considerable cost to any business. Building a business from a very lean staff basis means any funds raised go straight to growing the business rather than salaries.

Payroll can be one of the highest costs of a business and is so for the startup; this is a huge advantage.

The other aspect of startup success is that it allows for the launch of a new product at a much lower degree of risk. Working on the three stages of learning, building, and measuring, enable a startup to deliver a service that the market needs.

As long as they can successfully mitigate the common issues facing startups, there is much opportunity for growth.

With the rise in the use of software, this can automatically allow a business to scale. Sometimes a lack of scale proves fatal to a business as costs mount, but the company cannot exponentially grow its revenue.

This rapid growth can eclipse anything an established player can do. The fintech sector saw almost 40% in 12 months. This is nothing to scoff at as we’re talking about an industry valued in the hundreds of billions.

What Is The Future Of Startups?

Startups are not going anywhere anytime soon. Some startups have indeed turned into massive business empires over the past few years, and this success will spur others looking to become the next industry mogul.

The issue is that the unique idea that may spur so many towards thinking they can make it will only be a minor contributor to the potential of a startup for success.

Currently, the United States is the place to be if you want to get into startups. Not only is it the top country by the number of startups at over 60,000, but it also has some of the giant incubator and funding networks.

The numbers have shown that over 90% of startups fail, with over 50% not even making it five years. However, artificial intelligence is shaping up to be one of the most significant sources of startup focus in the coming years.

Advances in technology have heralded many breakthroughs. The rise of the internet into the 2000s, of course, saw a massive flow of money into any business that could make any half-credible claim about them being the next big success story.

However, so many of these firms were wiped out in the dot-com crash, which by late 2002 saw so many highly-valued startups having lost billions in value. Many hard lessons were learned, and professional investors are less likely to invest in ideas alone.

For a startup to get support, they need to show something else more substantial.

But the potential now is arguably even more significant. Technology can be made to feed off each other’s data and act accordingly. Algorithms can spot trends and serve customers content that they will almost certainly love.

Further, the miniaturization of technology and affordability are likely to see the next revolution be along these lines. If you have a smartphone, that means in your pocket is GPS, a personal computer, and the ability to have almost worldwide access to the internet.

On top of this, programmers and newer innovations like blockchain technology might push consumer trends in a different direction altogether, meaning that the next massive innovation that could change the world is just a startup right now.

So startups still have a significant role to play in the foreseeable future. What the next big thing is or who will come out on top is anyone’s guess, but the driving force behind these innovations is partly due to startups being able to exist.

They are trying to leverage new technologies or fill gaps in the market is not always best done by the big players. Economic theory tells us that established firms are less likely to be receptive to change and will be content to continue in their current course.

Out With The Old, In With The New

The future of startups is that the second iteration of the dot-com wave is unlikely to be sustainable.

Seemingly all it takes is coming up with a novel use of technology, getting a snappy social media marketing campaign, and then hoping to become the next unicorn. That can’t happen to everyone.

However, there are some critical advantages that startups have over traditional businesses. The shakeup of the banking sector is illustrative of how successful lean firms can be against the incumbents.

In banking, startups have shown how successfully leveraging technology is the key to capturing unserved customer needs.

The rise in user-friendly mobile experiences, emphasis on greater accessibility, and ability to operate outside the usual constraints that banks do have seen rapid growth for certain startups in the financial sector.

This success is not only limited to the fintech sector. Technology has been disrupting established players since the advent of civilization. Examples such as the move from blast furnaces to electric arc furnaces are one such instance.

Initially, electric arc furnaces did not capture the entire market from the traditional furnaces. Indeed, because electric arc furnaces worked better for special steel or Ferro melting, initially, it was just used for this purpose.

However, as the technology improved eventually, it came to dominate all forms of steel manufacture. Startups work on this principle, and so as long as market demand is met, startups will exist.

Glossary

The sharing economy consists of a near-zero marginal cost for services, with a most economic exchange happening over internet channels and through digital service platforms.

Portfolio companies are an investment term that defines a company in which the person making or managing the investment is not the majority owner but still has some control.

Silicon Valley is a region in northern California that has historically been home to many of the world’s high-tech industries.

Machine learning is a branch of artificial intelligence where computers learn from experience and decide based on learned information, rather than using in-built if-then statements.

Digital health is the use of technology in healthcare. The potential for digital health to improve healthcare delivery is enormous since it has been shown to increase access, reduce costs, and lead to better outcomes.

Cloud computing is a general term for the delivery of computing as a service rather than a product. A cloud can exist in either public or private infrastructure, but it must be provider-hosted. When you access Facebook or Twitter with your browser, you connect to the Facebook or Twitter Web server and use its services.

Funding rounds is a term that primarily applies to private equity and venture capital investing. It is the interval between when a new investor invests in the company and then sells some or all of their shares for (hopefully) an increased price.

The startup trend is the different trends you see in startups. The big thing that’s happening now is mobile. The Tech startup (technology startups) usually leads the way with app development and software development.

A venture investor is someone who provides funding for a start-up company, typically in the form of equity-based investments or loans, to see it grow. It’s one of several forms of business investment and can be a hazardous venture with either great success (bringing big profits) or failure (leaving the firm bankrupt).

Big data is defined as large chunks of data, including business information whose volume, velocity, and variety are so great that they become difficult to process using standard computing systems.

Virtual reality is the technology of simulated reality or provides life-like experiences through immersive computer-generated imagery and sound.

Startup culture is about taking risks and devoting your time to a big idea. The startup culture is usually a small company that acts like a big company, and a startup founder usually initiates the culture depending on the business idea. In recent years a new business will adopt remote working, which has created a unique culture that an Indian startup is remarkably to follow.

Remote work is when you can complete your job in a location away from your employer’s dictates. Popular with the small business, with this type of employment, there are great benefits for both parties – employers get a great valuation to save on business expenses, and remote employees can be closer to their families.

A business formation is the creation of a new company or venture, typically instituted to gain profit. A person may use their skills to create a new enterprise, or an industry outsider may establish ownership over an existing entity.