A startup achieving unicorn status is the ultimate dream for any entrepreneur. So how do these startups achieve such explosive growth and become worth billions of dollars?

Startups can become unicorns by building a product that solves a big problem for lots of people that is also valuable and unique.

An excellent example of this is Tesla Motors – they built an electric car with cutting-edge technology, and now everyone wants one! Or Airbnb – they’ve created an entire economy around sharing your space with others which have been invaluable for travelers worldwide.

Several steps need to happen for a startup to become a unicorn.

- The founders must have excellent judgment and foresee all possible outcomes.

- They must have an unending supply of energy, work ethic, and passion for their business idea or product.

- They must be able to assemble an incredible team with diverse skill sets which complement each other well.

- Lastly, but just as important – they need funding from angels/VCs who believe in their vision enough that they want in at the ground level so-to-speak.

It can be difficult for a startup to become a unicorn, but it can be done. The first step is to identify the key metrics that will determine if your company has achieved success in its industry and then focus on those things when raising money or looking for investors.

Some of the most critical factors include revenue model, valuation (how much an investor is willing to pay), stage of growth (is it still bootstrapping or profitable?), product-market fit (do customers love using your product?), and team strength. Once these questions have been answered affirmatively by all parties involved, then any other considerations about being a “successful” business become secondary until there is some objective evidence backing up such claims.

You’ll know you’ve reached this level of success when you raise more than 100 million dollars from investors, which is quite an accomplishment for any startup.

There are many different paths that a startup can take to raise more than 100 million dollars and reach the coveted $1 billion valuations. But in general, there are three primary stages that a startup will go through on its way to becoming a Unicorn.

- Ideation and validation: This is where the founders come up with their initial idea and test to see if it’s something people want or need. They do this by creating a Minimum Viable Product (MVP) and getting feedback from potential users or customers.

- Growth and traction: Once the startup has validated its idea, they begin to proliferate, often through word-of-mouth marketing. They focus on acquiring more customers and expanding their reach.

- Final phase: Companies enter mainstream markets and start generating profits at high levels because they have established themselves well enough to compete with more giant corporations in their respective industries.

As a startup, it is essential to know what you want its mission statement to be. It sets your course for success and will help guide all future decisions.

Your team should always know exactly where they are going with their marketing strategy so that every decision made aligns with strategic objectives.

A well-thought-out mission statement can protect from failure by allowing each member of the team to understand how their role fits into the more important goal as well as identify any potential pitfalls along the way. By taking time before launching your product or service, you’ll set yourself up for long-term success.

What Does Unicorn Startup Mean?

There is a lot of excitement in the air when someone talks about a unicorn startup. Investors and entrepreneurs are eager to discover new companies that can become unicorns. But what does this term mean?

A unicorn startup is a startup company that has achieved a billion-dollar valuation.

The term “unicorn startup” was first coined in 2013 by Aileen Lee, a partner at the venture capital firm Cowboy Ventures. At the time, there were only 39 companies in the world that qualified as unicorns. Today, there are over 219 unicorns.

The idea behind a startup company as a “unicorn” is that it’s rare and unique – different than other companies out there. It has to be innovative, has great people working for it, and be beloved by its customers, or else it won’t make it.

It also reflects how these businesses are often born out of one person’s vision rather than following an established path like other industries (e.g., cars). These companies can exist because someone has an idea they want to pursue; then, they create all sorts of necessary structures (legal entities) to make this happen.

It’s not easy to become a unicorn startup, but it’s not impossible either. It takes a lot of work and dedication. A unicorn startup is a company that has achieved a billion-dollar valuation.

The key to becoming a unicorn startup is to focus on growth and innovation. You need to have a great product or service that people want, and you need to scale quickly. You also need to be able to attract talented employees and investors.

If you’re able to do all those things, then you can achieve unicorn status. It may take some time and effort, but it’s possible.

What Does Turning Unicorn Mean?

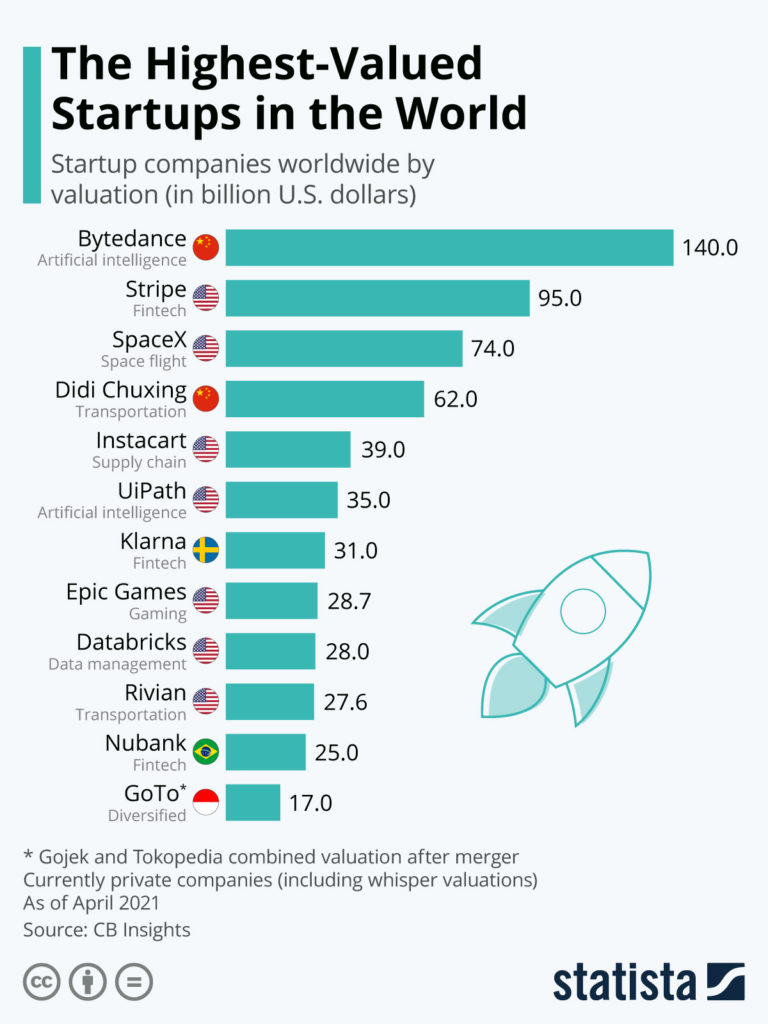

The term “unicorn” was coined in 2013 by Aileen Lee, founder of Cowboy Ventures, to describe startups that have achieved a billion-dollar valuation. And while it might seem like a lofty goal, the number of unicorns is growing every day. According to CB Insights, there were only 39 unicorns in 2013. But by the end of 2017, that number had more than doubled to 102. So what does turning unicorn mean?

Turning unicorn is a term used in the startup world to describe when a startup company achieves a billion-dollar valuation. This is considered a huge accomplishment, as it means that the company has achieved massive success and is on track for even greater things in the future.

It’s an outstanding achievement for any startup to reach this milestone, and it means that the company has a lot of potentials to grow and scale even further. Unicorn companies are typically those with high-growth potential and strong customer traction.

Reaching a billion-dollar valuation is no easy task, and it takes a lot of hard work, dedication, and innovation from the team behind it. So congratulations to all the startups out there who have made it to this stage.

What Is Unicorn Startup Funding?

If you’re an entrepreneur, you’ve probably heard about unicorn startup funding. But what is it? And how can you get your business to that point?

Unicorn startup funding is a type of startup funding that only lasts for the early stages of development. This means that it’s not intended to be long-term but instead used as an opportunity to garner attention and propel your company into success.

Unicorns are startups with $1 billion or more in valuation. So they’re already well established enough to have access to VC money from accredited investors, along with other sources like friends and family members who can invest through equity crowdfunding platforms like AngelList or Kickstarter (which also operate as “mini-VC” funds).

To be eligible for unicorn funding, your startup needs to have demonstrated traction and potential for growth. This could include having a large user base, a proven business model, or significant revenue.

For example, some accelerators and incubators offer funding and mentorship to early-stage companies, and there are venture capitalists who invest in more established companies. There are also crowdfunding platforms like Kickstarter or Indiegogo that allow startups to raise money from individual investors.

So, you don’t need to be a unicorn to receive unicorn funding. However, your startup will need to demonstrate that it has the potential to become one.

Three tips to how you can get unicorn funding:

- Have a great idea and be able to articulate it well. Investors want to know that you have a solid plan and that your business has potential for growth.

- Make sure your team is strong. Investors will want to see that you have the skills and experience necessary to make your business succeed.

- Get out there and network. Meeting people in the industry is a great way to find investors who may be interested in your startup business.

There are many different funding sources for startups, but the best way to get any is through an equity crowdfunding platform.

Crowdfunding sites like AngelList and Kickstarter provide a space where entrepreneurs can post their idea or project and ask people who might be interested in it to pledge money towards its completion.

These platforms take a percentage of what’s raised as well as processing fees, so they’re not free-to-use – but if you have an ambitious goal that doesn’t require excessive funds upfront (like most business ideas), then this could be your best option.

What Does The Unicorn Stage Mean?

If you’re an entrepreneur, you’ve no doubt been hearing a lot about unicorns lately. But what does this term mean, and why is it so important for startups?

The unicorn stage is the period in a startup’s life when it has achieved product/market fit and is growing quickly.

This is a fascinating time for the startup, as it has found a way to attract customers and grow rapidly. Unicorn startups are often coveted by larger companies because of their potential to scale even further.

When your startup is in the unicorn stage, you should make sure to capitalize on the growth you’re experiencing. Keep focusing on providing excellent value to your customers, and don’t let yourself get distracted by anything else.

Three things to expect before your startup reaches the unicorn stage:

- Expect to work harder than you ever have before. Achieving unicorn status requires a lot of hard work and dedication.

- Expect to make some sacrifices along the way. Making your startup successful will likely require sacrificing time with family and friends.

- Expect to face some challenges. There will be times when things don’t go as planned and you’ll have to overcome obstacles in order to reach your goals.

The unicorn stage in the customer’s journey is when they are more receptive to your marketing messages.

By understanding how your customers think, you can help them reach this critical point and increase sales by directing their attention toward your products or services.

Here’s what we know about the unicorn stage:

- The Unicorn Stage is a period of increased receptiveness during which people make more purchase decisions than at any other moment in the buyer’s journey. This unique window lasts only seconds but it counts for up to 40% of all purchases made online.

- It typically occurs between three and six screens into an individual’s browsing process on mobile devices.

- After that, people will either leave or go back to information gathering mode with little chance of conversion happening.

As you continue through these startup unicorn stages, it will be more and more difficult for competitors to catch up with your brand.

Fastest Unicorn Startups In The World

In the startup world, it’s all about moving fast and being first to market. So which startups have managed to achieve unicorn status in the shortest time possible?

There are a lot of factors that go into determining how fast a startup can grow. Some of the most important include the quality of the product or service, the level of customer demand, and the amount of funding and support from investors.

That said, here are four startups that have grown at an incredible pace in recent years:

- Airbnb – Airbnb is a web-based platform, founded in 2008, that connects people who need a place to stay with people who need to rent out extra space. In just a few years, Airbnb has become one of the most popular platforms for finding accommodations, and it’s now worth an estimated $25 billion.

- Uber – Uber is a transportation network company (TNC), founded in 2009, that connects passengers with drivers of vehicles for hire. With Uber, you can request a ride from your smartphone and track the driver’s location in real-time. As of early 2018, Uber was valued at $72 billion.

- Stripe – This company has quickly become the go-to choice for online businesses looking to process payments. In just a few short years, they’ve managed to snag some pretty impressive clients, including Apple, Facebook, and Twitter.

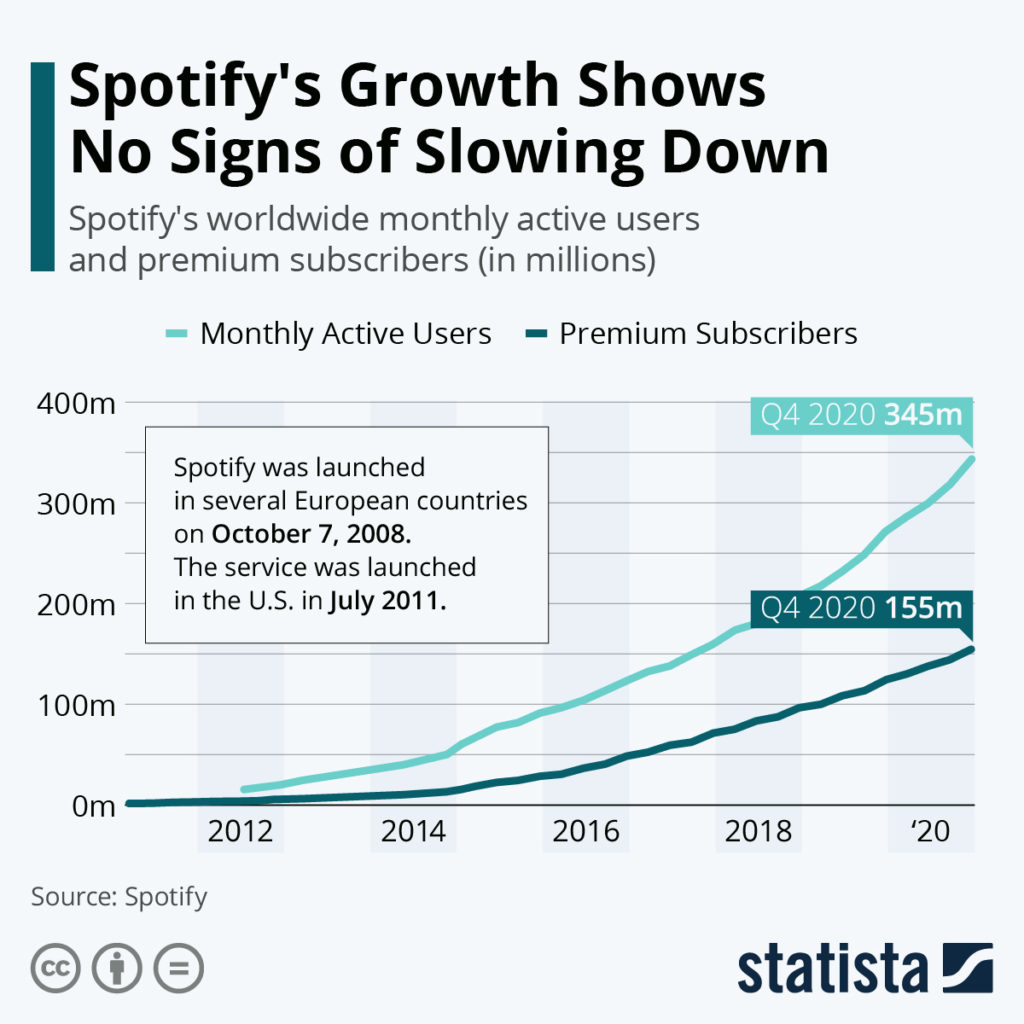

- Spotify – Spotify is a music streaming service that allows users to listen to millions of songs for free with ads, or for a monthly subscription without ads. It’s estimated that as of 2018, Spotify has over 200 million active users, making it the second most popular streaming service after YouTube.

The future of technology is bright, and we’re betting that these companies will continue to make waves as they redefine the world.

Which European country has the most startup unicorns?

There are a lot of ways to measure startup success, and it can be tricky to compare different countries’ apples-to-apples. But according to one study, the UK does have the highest number of startup unicorns in Europe.

So far in 2021, the UK has seen thirty-six startups achieve unicorn status, which is more than any other European country. These companies include Transferwise, Funding Circle, Skyscanner, Zoopla Property Group, SwiftKey, and Deliveroo. Of these six startups, Transferwise and Funding Circle are based in London while the other four are headquartered elsewhere in the UK.

The definition of a unicorn is a bit fuzzy, but most people agree that it’s a company with a billion-dollar valuation or more. And according to data from CB Insights, as of mid-2018, the UK had increased its unicorn stables outperforming more than any other European country. by 2021 France is second with 22 unicorns, followed by Germany also 22.

Conclusion

Startups that grow and become unicorns have a culture of innovation, creativity, and excellence. It’s not about the money; it’s about changing the world for the better through your product or service.

The unicorn stage means that you’re in an exclusive club where your company’s value is expected to surpass 1 billion dollars. This isn’t a destination but rather a milestone along the journey towards turning into one of those rare beasts called unicorns.

Quick Answers To Frequently Asked Questions

Is Andreessen Horowitz a venture capitalist unicorn company?

Yes, Andreessen Horowitz is a venture capitalist unicorn company. According to data from the startup database Crunchbase, the Menlo Park, California-based firm has raised more than $1.5 billion since it was founded in 2009. Notable investments include Facebook, Dropbox, and Airbnb.

Does tech startup rapid growth require tiger global management?

Not at all. While tiger global management has been known to invest in tech startups and help them grow rapidly, it’s not required for this type of success. There are many other investors out there who can provide the same level of support and guidance, and often times the startup will be better off with a more personal connection to their investor.

That said, tiger global management does have a lot of experience and knowledge when it comes to helping startups grow, so if you’re looking for this type of support, they would be a great option to consider. Just make sure you do your research and find an investor who is the best fit for your specific company and needs.

Is there a real estate unicorn founder in the United States?

There are a few real estate unicorn founders in the United States. These entrepreneurs have built companies that are worth more than $1 billion. Some of the most notable names include Jeff Greene, Gary Vaynerchuk, and Barry Sternlicht.

Each of these individuals has achieved remarkable success in the real estate industry. They have each created businesses that have transformed the way people think about and interact with this sector. And they continue to play a major role in its growth and development.

Is there a tech unicorn club in San Francisco North America?

There are plenty of tech startups in the San Francisco Bay Area, but it’s difficult to know if they are all unicorns.

The term “unicorn” is often thrown around loosely by investors and entrepreneurs when referring to a company that has been successful enough to reach a valuation of over one billion dollars. However, there is no specific club for these types of companies in San Francisco North America. There may be clubs or meetups for other types of businesses within the city such as silicon valley or san mateo county, where you could find out more information on what kind of opportunities might exist near you.

Are venture capital investments only for the privately held startup company?

No. Venture capitalists are looking for a return on their investment, and the best way to get that is by investing in companies that have the potential to go public.

There are a few different ways for a startup company to go public. They can either issue stock through an initial public offering (IPO), they can be acquired by a larger company, or they can merge with another company. In most cases, the venture capitalists will want the company to go through an IPO so that they can cash out and make a return on their investment. However, there are some cases where the venture capitalists will hold on to their shares and wait for the company to be acquired or merged.

Difference between DST Global and Temasek Holdings?

There is a big difference between the two companies. DST Global is a venture capital firm that specializes in technology investments, while Temasek Holdings is a state-owned investment company based in Singapore.

DST Global was founded by Russian billionaire Yuri Milner and has made some major tech investments over the years, including Facebook, Twitter, and Alibaba. Temasek Holdings, on the other hand, has more than $235 billion in assets under management and owns stakes in some of the biggest companies in Asia, such as Singapore Airlines, Bank of China, and Tencent Holdings.

Is Y Combinator a private company?

Y Combinator is a private company, and it has been since its inception in 2005. It’s one of the most successful startup accelerators in the world, and has helped to launch some of the most well-known startups out there, including Airbnb, Dropbox, and Stripe.

Difference between insight partners and general catalyst?

Insight partners are designed to work with a specific customer or customers, whereas general catalysts can be used in different industries.

Insight partners are typically more targeted than general catalysts because they’re created with the goal of helping one company achieve its goals. General catalysts may not have this focus and could theoretically help multiple companies reach their targets by increasing market share for all businesses involved.

Difference between startup valuation and index ventures?

Startup valuation is the price at which a company may be sold in an initial public offering (IPO) or when it is first offered for sale to the general public. In contrast, index ventures are based on their weightings in various stock market indexes such as S&P 500 and Nasdaq-100.

A startup’s valuation will depend on many factors including; revenue projections, the profitability of past businesses owned by individuals currently running the company, competition within the industry, etc., whereas index venture prices change periodically depending upon how stocks fare over time due to volatility in markets. Startup valuations can also vary greatly depending on if they are private or public offerings while index ventures cannot exceed 18 times higher than liquidation value(s).

Does the startup founding team receive pay from the initialized capital?

There is no one-size-fits-all answer to this question, as it can vary depending on the specific startup and the terms of the founding team’s agreement. However, in general, the founders of a startup typically do not receive pay from the initialized capital until after the company has been successfully launched and begun generating revenue. This is because the early stage of a startup is typically considered to be a high-risk investment, and investors are usually reluctant to allocate too much money to salaries when there is so much uncertainty surrounding the venture.