Startups are the future of business. They’re small companies that have big ideas, and they’re often more innovative than large corporations. Startups provide a lot of jobs as well as new products and services to help grow our economy.

For these reasons, entrepreneurs need to know startups to find opportunities for success in this growing industry.

Startups are essential because they break molds, fix problems, and empower individuals to build the future. They provide us with fresh innovations and services, which may be more relevant to the world’s needs. Without cutting-edge startups, we would be stuck using typewriters at photocopying machines.

Startups are a great way to shape business and global dynamics. Let’s examine ten more reasons as to why startups are essential:

- Entrepreneurship helps maintain a fast-paced environment where innovation is constantly being explored and encouraged.

- Startups are innovative because they can adapt to changes in the market or new technologies easily, not many big companies have the agility that startups have. Changing marketplace demand does not sound alarms within a company as it would with a Startup team that is keen on staying one step ahead of the competition.

- Startups serve as a creative outlet for employees that have or desire to push the boundary a bit or find professional satisfaction in following their own dreams instead of meeting someone else’s expectations.

- They can give you more freedom at work than what is conventionally offered by bigger companies because startups usually offer non-typical office hours (e.g., flex time) high control at work.

- More opportunities for networking with young entrepreneurs can help accelerate the learning curve which has benefits over time, especially considering how competitive the job market has become.

- Creativity and brainstorming sessions bring out new ideas and concepts for established companies on how to improve on an idea or rethink existing ones but this is often impossible in smaller-sized groups often time due to limitations of resources which allow for less flexibility on thinking outside mainstream thought processes.

- Startups allow a large adjustment in the short term to economic downturns. When a big company gets hit by a recession, it takes much longer for them to make adjustments because of commitments and other reasons.

- It helps bring diversity into spaces where there might not be any before. In the way startups look at problems, they’re more inclined to think outside the box and try something different than what a company may have been doing for years if not centuries.

- Startups provide a change from the status quo and this is necessary for the evolution of human society. Silicon Valley may be critical to maintaining that innovation in different sectors of society – including increasingly important technology, green tech, medical care, and energy sectors.

- Startups encourage workplace innovation with an informal workplace where creativity can thrive and innovation can be propagated from one person to several others quickly. The risk involved in starting a business is small enough that even if many ideas or products fail it won’t hurt the company’s lifeblood too badly.

Startups create jobs, new ideas, and innovations for the economy. Three points to sum up your awareness:

- Startup founders will be challenged by other startups in their market which can help them innovate to stay ahead of competitors.

- The government should provide tax breaks to startups so that they have more capital to grow with while also creating an environment where entrepreneurs want to build businesses.

- If the startup fails it’s not a total loss as employees may get hired at another company or find work elsewhere in the industry. Startup failures often spur innovation within different industries helping society thrive through creativity and entrepreneurship.

We must support these companies and be one ourselves if possible to create a better future for everyone!

Why Are Startups Important To The Economy?

The world’s most successful entrepreneurs have created companies that are now household names. The success of these businesses has had a tremendous impact on the economy, providing jobs for people all over the globe.

Startups are essential to the economy because they create new jobs. They are young, bold companies that have unique ideas for product development. And in so doing, these companies provide their employees with opportunities for growth and career advancement in an economy where many youths have not been fortunate enough to find a job.

Startups maintain massive importance in our society to develop thorough knowledge transfer and information exchange, which only grows when there is economic prosperity.

Reasons why startups are essential to the economy:

- At this moment there are over 450,000 startups in the US alone. The one thing they all have in common? They’re working to fix problems. As customers, we want products that are tailored to solve our specific needs, and we as customers should be demanding these innovations because it’s what will continue to drive economic growth. Problems need solving!

- Startups seem to move in the opposite direction during recessions – by having more startups during downturns, additional jobs are created so the rate of unemployment doesn’t rise as much as it otherwise would have.

- Startups create jobs – an increase in startups means an increase in creating new jobs to support them by hiring more employees or even outsourcing customers need to be hired only when startups grow bigger so the customer service problems won’t come up

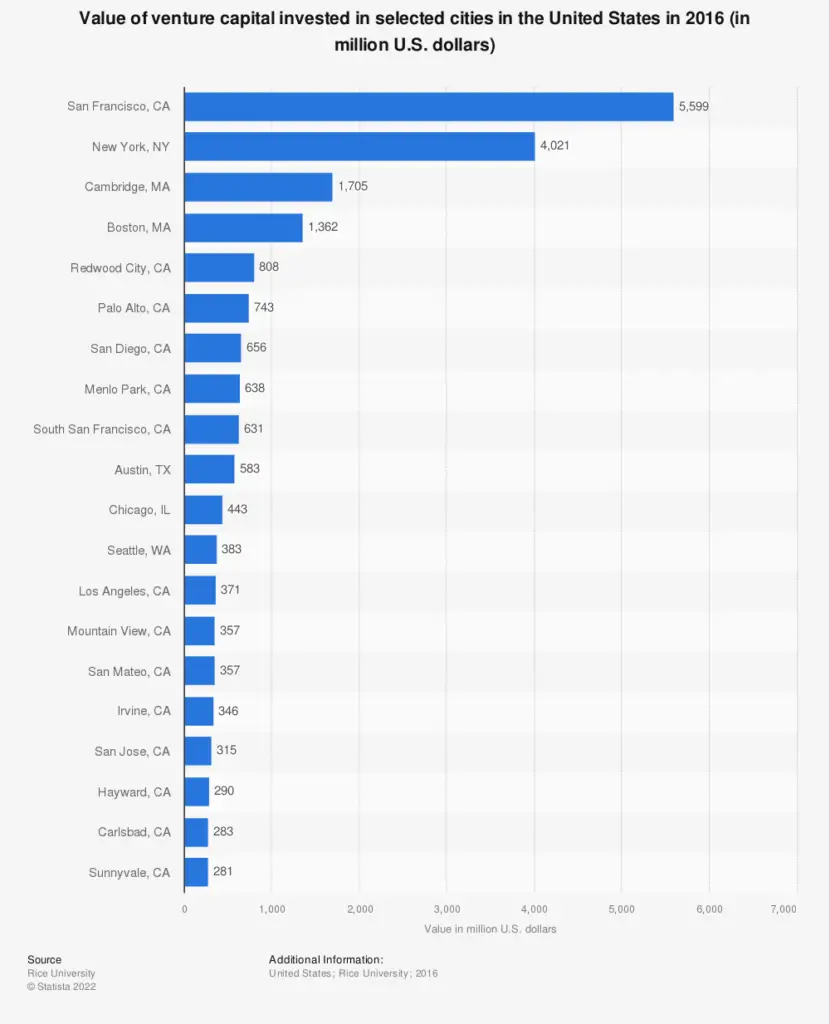

- Venture backed companies account for 80% of the 10% GDP that comes from exports.

- Startups give consumers more options to choose from, which also enhances competition in all related industries. Competition leads to lower prices for consumers and an improved product for everyone involved.

- Technology startups can help many other businesses succeed by enabling them to scale quickly when they otherwise couldn’t without turning off their cash flow.

- A startup company invents new products, researches for breakthroughs in their industry, and enhances industries with its creative thinkers. They also develop technologies that are more efficient and better for the environment.

- Startups are important to the economy because they can later evolve into successful businesses which employ many people across different types of industries, making it crucial for development on a national scale by promoting growth of progress past what was already achieved before startups existed.

- Startups often create ground-breaking innovations which can help eliminate problems at other companies, meaning they may save people time or help them accomplish their tasks more effectively, leading to increased productivity and profits across industries.

- The successes of these companies lead not only to new jobs but also an interconnected web which creates countless opportunities for startup founders to develop industry expertise and venture capital networks

Startups are essential to the economy and offer many opportunities, and they also create jobs for people who may not be able to find work elsewhere. Startups need funding, but there is no shortage of investors looking to get in on the ground floor! With all these factors combined, it’s easy to see why startups are such an integral part of our country’s economic growth.

Why Are Startups Valued So High?

Most startups are valued at a high amount, but what makes them so valuable? People want to know that the company they invest in will be profitable and have some return on their investment, even if it’s just a small one.

The idea is that you’re investing your money into something with a higher chance of success than other investments because there is more risk involved with this type of business model.

If investors want to invest in the startup, then the marketplace should take notice of that interest, and prices for that stock should go up. They are attracting high-risk investments with broad horizons of a potentially high return on investment, aiming more for IPO-type growth rather than aiming more towards early profitability.

A startup is, by definition, a small, usually young company that has little to no assets other than its potential addressable market niche and founders. It’s why entrepreneurs might be intelligent but still have no idea how to handle money or responsibility since it’s not easy for people who’ve never done anything before in their lives with little money per se.

If 10 out of 14 startups fail, then the investor is only at risk for .07% of their invested capital – and if they happen to be right about one of them, then they’re sitting pretty with a 500-1000+ return on investment.

Valuing startups is very simple; the idea is like this with five general points:

- In general, startups are valued high because they have a LOT of growth potential as opposed to established companies which have typically slowed down as they progress in age.

- There is no “set” value for a startup company or any company for that matter, so it’s possible that the value is based on greed and manipulation more than anything else even with good intentions.

- Extremely talented teams are willing to take a chance to join young companies with an unproven strategy. They see the potential and want to be part of building something big. If they succeed, they will be in the same position as before, but if they fail and stick with their old company, it is very likely that eventually their job will disappear in the near future due to outsourcing or automation.

- The higher valuation makes the company more attractive to investors – Higher valuations make companies more appealing to potential investors. Venture capitalists, which might typically only deal with companies worth less than $1 billion, might be interested in working with startups given their potential for growth or ability to attract other investments in the future.

- Fearsome competition makes for a strong company. In order to have a competitive edge, startups have to always innovate and focus on the product itself rather than competitors’ products. When other companies copy you instead of competing with you, it’s an indication that the innovative capability is taking effect and people are excited about what it produces.

Startups are valuable because they increase. Startups value so high because investors know the company will continue to grow and increase in value. They can’t be valued by traditional ways of valuing a firm like Book Value or Net Present Value. This is partly why Silicon Valley keeps booming while other less innovative regions don’t see such growth.

The most successful startups have used their small size as an advantage by focusing on specific markets or developing niche products that competitors don’t offer.

Successful startups also focus heavily on creating a good product and customer service experience from the beginning, ensuring they grow into profitable companies rather than falling apart, as many other startup ventures do.

Why Are Startups Overvalued?

Startups often carry significant risk, but sometimes value can be underestimated, and they’re overvalued (such as the case of Facebook and the Sharing Economy). It’s important to understand that startups can be on opposite ends of the spectrum.

A startup is overvalued when investors believe it is worth more than it is. The value of a company’s stock is often relative to cash flows (e.g., consider that Google has an operating margin of 31%, but Amazon has an operating margin of 1%).

Investors are given information, including annual projections and industry growth rates, to form their opinion on the company’s prognosis for success.

But some companies have better assets on paper than others, so this always creates a certain level of exposure risk regarding being overvalued, all else being equal. Investors fall victim to their greed in some cases by feeling excited about what could be instead of focusing on what can be.

A common misconception is that a startup is overvalued if bought at an unusually high price, such as Snapchat, for 3 billion dollars. But some startups (including some successful companies) might deserve such an expensive buyout because they make more than double their investment with one or two years.

Rupert Murdoch recently called startup investing a “mania” and criticized Silicon Valley for its inflated valuation of tech startups. His remarks came just days after StartupValuation released their report that found that startups could be overvalued by as much as $94 billion because investors weigh in on what investees should earn rather than how much their company is worth.

Unfortunately, investors often buy into the hype without understanding underlying economics, leading to doubly dangerous stock frauds.

Startups can be successful, but it is rare for startups to do well in the long term without substantial financial investment from an early-stage investor or wealthy individual.

It’s also challenging to know if you should invest your money into startup investments until they have been tested and proven with time.

Inherently, there will always be some risk when investing in any company that has not yet established itself as a profitable business model. There are many factors at play when deciding whether or not to invest in a startup, so consider all aspects before making this decision.

Conclusion

Startups are an essential part of the economy and help to create new jobs. They also provide innovation for existing industries by taking risks that established companies might not take. This is why startups are valued so high because they’re seen as vehicles for change in society. With this kind of potential, it’s no wonder investors love them!

Every startup has a different story, whether it be how they were founded or their goal when launching into business. These stories can inspire us all to dream significantly about our future endeavors and motivate us to work hard towards achieving those goals every day!

Quick Answers To Frequently Asked Questions

Does the startup ecosystem contribute to job creation?

Absolutely. Entrepreneurs create jobs since they have to hire people in order to produce or sell their products or service. The Startup Ecosystem helps entrepreneurs by reducing the risk of starting a business – because there are avenues for research and learning how to build it yourself, as well as more affordable licensing for doing so.

Difference between entrepreneur and startup founder?

An entrepreneur is someone who organizes and operates a business as a professional. A startup founder is an individual or group that builds an entity from the ground up, usually with the goal of making strategic changes in society.

How do technology startup firms get potential customers?

Startups in the tech industry usually get their customers by visiting trade shows and conferences to talk face to face with people who might be potential customers. Here they can hand out different promotional items such as branded thumb drives, pens, stickers, and flyers that advertise what the company does and how their product or service can help solve an issue. This is mainly done through business-to-business marketing techniques.

Does the lean startup accelerator create job growth?

Yes. A lean startup accelerator program, like the ones we offer with Praxis and YCombinator, works to create jobs and give startups an opportunity for success.

Difference between startup culture and company culture?

A startup’s culture is usually very different from company culture. For one, it is often more diverse due to the diversity of people working on the project of creating something new. It also has an atmosphere that would seem hectic or chaotic to most new employees, but there are distributed teams so there are many people who work closely together. Finally, they have a voice in how things are done unlike in most large organizations.

Difference between existing firms and young firms?

Existing firms have more financial security, a history of large transactions, and have been around long enough to establish a reputation. Young firms offer more diversity and access to innovation. They often work as extensions of the individual creator, as someone with an “idea” or passion that they want to share with others.

How was the startup community affected by the covid 19 crisis?

The startup community was deeply impacted by the covid 19 crisis, not only because of the devastation it wrought on the airline industry, but also because it took so many young entrepreneurs with them.

How does a new business use social media to reach angel investors?

It’s essential for a business to have social media pages and posts with images and videos to attract investors. Social media platforms allow people or companies to post their blogs, advertise themselves, and interact with potential customers. Investors will hear about businesses through social networking such as Twitter, Facebook, Instagram, LinkedIn, etc. Businesses should be consistent in posting high-quality content on these apps so they’ll become more recognizable among others. It’s important that the right image is sent out so it attracts interest from those watching/following the account on those particular mediums.

Difference between a successful startup and a startup failure in the private sector?

A successful startup has a large market share and is showing increasing levels of profit, whereas a failed startup will either show an overall loss trend or be operating with negative equity. A company may also fail because it can’t manage its liabilities wisely. However, startups do not need to take on debt to pursue the opportunities they consider most profitable.

What early stage startup activity contributes to employment growth?

I would be totally remiss if I didn’t point out the fact that job growth in early-stage companies is a potential benefit to a country’s GDP. Jobs grow because people want access to goods and services, and by developing products and offering them at a lower price with higher quality, jobs are created all around the world for manufacturers, distributors, retailers, servers, etc.

Difference between a large company and a large corporation?

Corporations, which are created as a legal entity according to the law of their nation with its own set of finances, represent a large body that is made up of shareholders. In contrast to companies, corporations have management that exists as an integral part of its shareholders and those represented by those running it.

How does a new firm tech startup perform in the emerging markets?

Firms with sufficient capital and robust logistical systems will be able to enter new markets without too much difficulty, while startups or resource-limited firms may find that entering these newer markets is not for the faint of heart. Newer markets often require very different strategies than older, more established ones. Resource-constrained firms should consider partnering with a strategic partner in the target country while they provide critical inputs and develop their strength in adjacent market sectors (such as developing economies) before trying to enter the newest emerging market.